HP 2013 Annual Report Download - page 34

Download and view the complete annual report

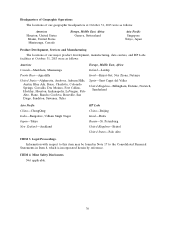

Please find page 34 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.services and highly volatile exchange rates. We may incur significant losses from our hedging activities

due to factors such as volatility and currency variations. In addition, our hedging activities may be

ineffective or may not offset any or more than a portion of the adverse financial impact resulting from

currency variations. Losses associated with hedging activities also may impact our revenue and to a

lesser extent our cost of sales and financial condition.

In many foreign countries, particularly in those with developing economies, it is common to engage

in business practices that are prohibited by laws and regulations applicable to us, such as the Foreign

Corrupt Practices Act (the ‘‘FCPA’’). For example, as discussed in Note 17 to the Consolidated

Financial Statements, the German Public Prosecutor’s Office, the U.S. Department of Justice and the

Securities and Exchange Commission have been investigating allegations that certain current and

former employees of HP engaged in bribery, embezzlement and tax evasion. In addition, the U.S.

enforcement authorities, as well as the Polish Central Anti-Corruption Bureau, are conducting

investigations into potential FCPA violations by a former employee of an HP subsidiary in connection

with certain public-sector transactions in Poland, and the U.S. enforcement authorities are conducting

investigations into certain other public-sector transactions in Russia, Poland, the Commonwealth of

Independent States and Mexico, among other countries. Although we implement policies and

procedures designed to facilitate compliance with these laws, our employees, contractors and agents, as

well as those companies to which we outsource certain of our business operations, may take actions in

violation of our policies. Any such violation, even if prohibited by our policies, could have an adverse

effect on our business and reputation.

Any failure by us to identify, manage, complete and integrate acquisitions, divestitures and other significant

transactions successfully could harm our financial results, business and prospects, and the costs, expenses and

other financial and operational effects associated with managing, completing and integrating acquisitions may

result in financial results that are different than expected.

As part of our business strategy, we may acquire companies or businesses, divest businesses or

assets, enter into strategic alliances and joint ventures and make investments to further our business

(collectively, ‘‘business combination and investment transactions’’). In order to pursue this strategy

successfully, we must identify candidates for and successfully complete business combination and

investment transactions, some of which may be large or complex, and manage post-closing issues such

as the integration of acquired businesses, products, services or employees. Risks associated with

business combination and investment transactions include the following, any of which could adversely

affect our revenue, gross margin, profitability and financial results:

• Managing business combination and investment transactions requires varying levels of

management resources, which may divert our attention from other business operations.

• We may not fully realize all of the anticipated benefits of any business combination and

investment transaction, and the timeframe for realizing benefits of a business combination and

investment transaction may depend partially upon the actions of employees, advisors, suppliers

or other third-parties.

• Business combination and investment transactions have resulted, and in the future may result, in

significant costs and expenses and charges to earnings, including those related to severance pay,

early retirement costs, employee benefit costs, goodwill and asset impairment charges, charges

from the elimination of duplicative facilities and contracts, asset impairment charges, inventory

adjustments, assumed litigation and other liabilities, legal, accounting and financial advisory fees,

and required payments to executive officers and key employees under retention plans.

• Any increased or unexpected costs, unanticipated delays or failure to meet contractual

obligations could make business combination and investment transactions less profitable or

unprofitable.

26