HP 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 13: Taxes on Earnings (Continued)

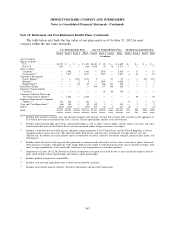

Deferred Income Taxes

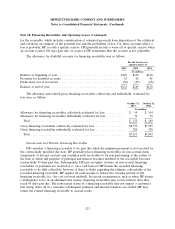

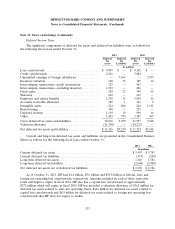

The significant components of deferred tax assets and deferred tax liabilities were as follows for

the following fiscal years ended October 31:

2013 2012

Deferred Deferred Deferred Deferred

Tax Ta x Ta x Tax

Assets Liabilities Assets Liabilities

In millions

Loss carryforwards .............................. $ 9,807 $ — $ 9,142 $ —

Credit carryforwards ............................. 4,261 — 3,884 —

Unremitted earnings of foreign subsidiaries ............ — 7,469 — 7,559

Inventory valuation .............................. 128 13 185 12

Intercompany transactions—profit in inventory .......... 125 — 463 —

Intercompany transactions—excluding inventory ......... 1,923 — 881 —

Fixed assets ................................... 289 72 349 65

Warranty ..................................... 622 — 663 —

Employee and retiree benefits ...................... 2,350 11 3,264 16

Accounts receivable allowance ...................... 185 1 161 2

Intangible assets ................................ 224 886 264 1,111

Restructuring .................................. 340 — 225 —

Deferred revenue ............................... 1,119 19 969 16

Other ........................................ 1,443 759 1,107 367

Gross deferred tax assets and liabilities ................ 22,816 9,230 21,557 9,148

Valuation allowance ............................. (11,390) — (10,223) —

Net deferred tax assets and liabilities ................. $11,426 $9,230 $ 11,334 $9,148

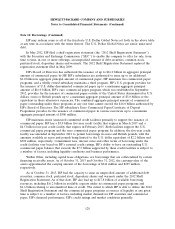

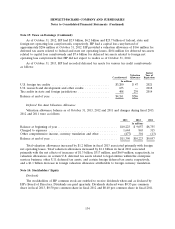

Current and long-term deferred tax assets and liabilities are presented in the Consolidated Balance

Sheets as follows for the following fiscal years ended October 31:

2013 2012

In millions

Current deferred tax assets .......................................... $3,893 $ 3,783

Current deferred tax liabilities ....................................... (375) (230)

Long-term deferred tax assets ........................................ 1,346 1,581

Long-term deferred tax liabilities ..................................... (2,668) (2,948)

Net deferred tax assets net of deferred tax liabilities ....................... $2,196 $ 2,186

As of October 31, 2013, HP had $1.4 billion, $5.6 billion and $30.8 billion of federal, state and

foreign net operating loss carryforwards, respectively. Amounts included in each of these respective

totals will begin to expire in fiscal 2014. HP also has a capital loss carryforward of approximately

$272 million which will expire in fiscal 2015. HP has provided a valuation allowance of $162 million for

deferred tax assets related to state net operating losses, $104 million for deferred tax assets related to

capital loss carryforwards and $8.9 billion for deferred tax assets related to foreign net operating loss

carryforwards that HP does not expect to realize.

133