HP 2013 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

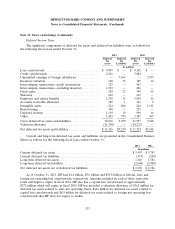

Note 13: Taxes on Earnings (Continued)

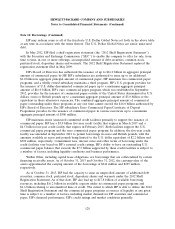

As a result of certain employment actions and capital investments HP has undertaken, income

from manufacturing and services in certain countries is subject to reduced tax rates, and in some cases

is wholly exempt from taxes, through 2024. The gross income tax benefits attributable to these actions

and investments were estimated to be $827 million ($0.42 diluted net earnings per share) in fiscal 2013,

$900 million ($0.46 diluted net earnings per share) in fiscal 2012 and $1.3 billion ($0.62 diluted net

earnings per share) in fiscal 2011. The gross income tax benefits were offset partially by accruals of

U.S. income taxes on undistributed earnings, among other factors.

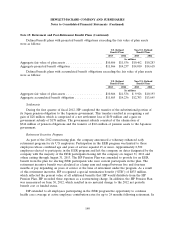

Uncertain Tax Positions

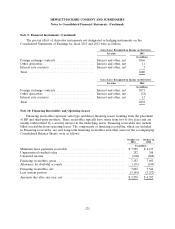

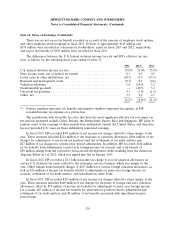

A reconciliation of unrecognized tax benefits is as follows:

2013 2012 2011

In millions

Balance at beginning of year ................................... $2,573 $2,118 $2,085

Increases:

For current year’s tax positions .............................. 290 209 384

For prior years’ tax positions ................................ 997 651 426

Decreases:

For prior years’ tax positions ................................ (146) (321) (159)

Statute of limitations expiration .............................. (11) (1) (20)

Settlements with taxing authorities ............................ (219) (83) (598)

Balance at end of year ........................................ $3,484 $2,573 $2,118

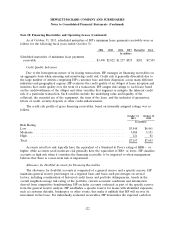

Up to $1.9 billion, $1.4 billion and $1.1 billion of HP’s unrecognized tax benefits at October 31,

2013, 2012 and 2011, respectively, would affect HP’s effective tax rate if realized.

HP recognizes interest income from favorable settlements and income tax receivables and interest

expense and penalties accrued on unrecognized tax benefits within income tax expense. As of

October 31, 2013, HP had accrued $196 million for interest and penalties.

HP engages in continuous discussion and negotiation with taxing authorities regarding tax matters

in various jurisdictions. HP does not expect complete resolution of any U.S. Internal Revenue Service

(‘‘IRS’’) audit cycle within the next 12 months. However, it is reasonably possible that certain federal,

foreign and state tax issues may be concluded in the next 12 months, including issues involving transfer

pricing and other matters. Accordingly, HP believes it is reasonably possible that its existing

unrecognized tax benefits may be reduced by an amount up to $1.1 billion within the next 12 months.

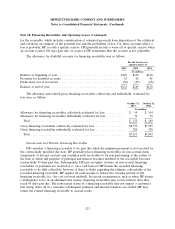

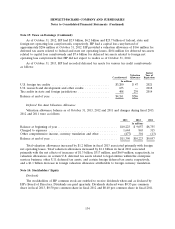

HP is subject to income tax in the United States and approximately 80 other countries and is

subject to routine corporate income tax audits in many of these jurisdictions. In addition, HP is subject

to numerous ongoing audits by state and foreign tax authorities. The IRS is conducting an audit of

HP’s 2009, 2010 and 2011 income tax returns. HP has received from the IRS Notices of Deficiency for

its fiscal 1999, 2000, 2003, 2004 and 2005 tax years, and Revenue Agent’s Reports (‘‘RAR’’) for its fiscal

2001, 2002, 2006, 2007 and 2008 tax years. The proposed IRS adjustments for these tax years would, if

sustained, reduce the benefits of tax refund claims HP has filed for net operating loss carrybacks to

earlier fiscal years and tax credit carryforwards to subsequent years by approximately $446 million.

131