HP 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 2: Stock-Based Compensation (Continued)

HP’s PRU program provides for the issuance of PRUs representing hypothetical shares of HP

stock. Each PRU award reflects a target number of shares (‘‘Target Shares’’) that may be issued to the

award recipient before adjusting for performance and market conditions. The actual number of shares

the recipient receives is determined at the end of a three-year performance period based on results

achieved versus company performance goals and may range from 0% to 200% of the Target Shares

granted. No PRUs were granted in fiscal 2013. The performance goals for PRUs granted in fiscal 2012

are based on HP’s adjusted annual cash flow from operations as a percentage of revenue and on HP’s

adjusted annual revenue growth. The performance goals for PRUs granted prior to fiscal 2012 are

based on HP’s adjusted annual cash flow from operations as a percentage of revenue and on a market

condition based on total shareholder return (‘‘TSR’’) relative to the S&P 500 over the three-year

performance period.

Recipients of a PRU award generally must remain employed by HP on a continuous basis through

the end of the applicable three-year performance period in order to receive shares subject to that

award. Target Shares subject to PRU awards do not have dividend equivalent rights and do not have

the voting rights of common stock until earned and issued following the end of the applicable

performance period. The expense for these awards, net of estimated forfeitures, is recorded over the

requisite service period based on the number of Target Shares that are expected to be earned and the

achievement of performance goals during the performance period.

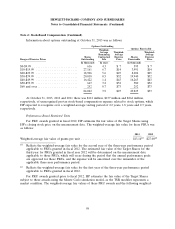

Restricted Stock Awards

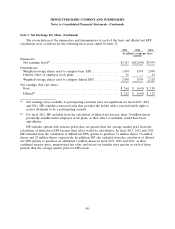

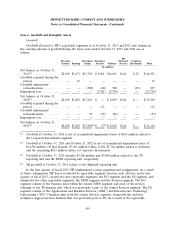

Non-vested restricted stock awards as of October 31, 2013, 2012 and 2011 and changes during

fiscal 2013, 2012 and 2011 were as follows:

2013 2012 2011

Weighted- Weighted- Weighted-

Average Grant Average Grant Average Grant

Date Fair Value Date Fair Value Date Fair Value

Shares Per Share Shares Per Share Shares Per Share

In thousands In thousands In thousands

Outstanding at beginning

of year ............. 25,532 $31 16,813 $39 5,848 $45

Granted ............. 20,707 $15 20,316 $27 17,569 $38

Vested .............. (10,966) $33 (8,521) $38 (5,660) $41

Forfeited ............. (3,011) $24 (3,076) $34 (944) $43

Outstanding at end of

year ............... 32,262 $21 25,532 $31 16,813 $39

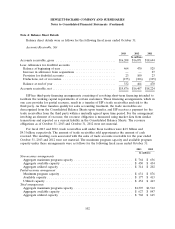

At October 31, 2013, 2012 and 2011, there was $330 million, $508 million and $526 million,

respectively, of unrecognized pre-tax stock-based compensation expense related to non-vested restricted

stock awards, which HP expected to recognize over the remaining weighted-average vesting period of

1.3 years, 1.3 years and 1.4 years, respectively.

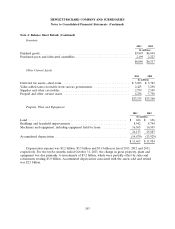

Stock Options

HP utilizes the Black-Scholes-Merton option pricing formula to estimate the fair value of stock

options subject to service-based vesting conditions that are granted under its principal equity plans. HP

estimates the fair value of stock options subject to performance-contingent vesting conditions using a

combination of a Monte Carlo simulation model and a lattice model, as these awards contain market

conditions.

96