HP 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

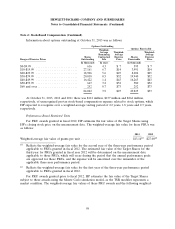

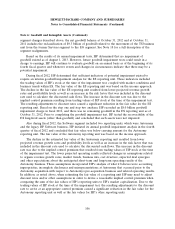

Note 2: Stock-Based Compensation (Continued)

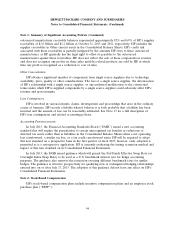

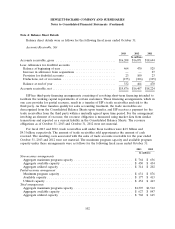

Information about options outstanding at October 31, 2013 was as follows:

Options Outstanding

Options Exercisable

Weighted-

Average Weighted- Weighted-

Remaining Average Average

Shares Contractual Exercise Shares Exercise

Range of Exercise Prices Outstanding Life Price Exercisable Price

In thousands In years In thousands

$0-$9.99 .......................... 616 4.3 $ 7 595 $ 7

$10-$19.99 ........................ 27,161 6.7 $14 3,991 $14

$20-$29.99 ........................ 18,906 5.6 $25 8,204 $25

$30-$39.99 ........................ 20,018 0.5 $32 19,940 $32

$40-$49.99 ........................ 16,422 1.4 $43 16,263 $43

$50-$59.99 ........................ 667 3.2 $52 580 $52

$60 and over ....................... 252 0.7 $73 252 $73

84,042 3.9 $27 49,825 $33

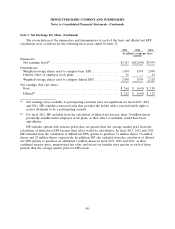

At October 31, 2013, 2012 and 2011 there was $112 million, $157 million and $264 million,

respectively, of unrecognized pre-tax stock-based compensation expense related to stock options, which

HP expected to recognize over a weighted-average vesting period of 2.2 years, 1.8 years and 2.3 years,

respectively.

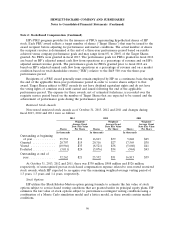

Performance-Based Restricted Units

For PRU awards granted in fiscal 2012, HP estimates the fair value of the Target Shares using

HP’s closing stock price on the measurement date. The weighted-average fair value for these PRUs was

as follows:

2013 2012

Weighted-average fair value of grants per unit ............................ $13.14(1) $27.00(2)

(1) Reflects the weighted-average fair value for the second year of the three-year performance period

applicable to PRUs granted in fiscal 2012. The estimated fair value of the Target Shares for the

third year for PRUs granted in fiscal year 2012 will be determined on the measurement date

applicable to those PRUs, which will occur during the period that the annual performance goals

are approved for those PRUs, and the expense will be amortized over the remainder of the

applicable three-year performance period.

(2) Reflects the weighted-average fair value for the first year of the three-year performance period

applicable to PRUs granted in fiscal 2012.

For PRU awards granted prior to fiscal 2012, HP estimates the fair value of the Target Shares

subject to those awards using the Monte Carlo simulation model, as the TSR modifier represents a

market condition. The weighted-average fair values of these PRU awards and the following weighted-

98