HP 2013 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

the HP Retiree Welfare Benefits Plan. HP currently leverages the employer group waiver plan process

to provide HP Retiree Welfare Benefits Plan post-65 prescription drug coverage under Medicare

Part D, thereby giving HP access to federal subsidies to help pay for retiree benefits.

Certain employees not grandfathered under the above programs, as well as employees hired after

2002 but before August 2008, are eligible for credits under the HP Retirement Medical Savings

Account Plan (the ‘‘RMSA’’) upon attaining age 45. Credits offered after September 2008 are provided

only in the form of matching credits on employee contributions made to a voluntary employee

beneficiary association. Upon retirement, former employees may use these credits for the

reimbursement of certain eligible medical expenses, including premiums required for coverage.

Defined Contribution Plans

HP offers various defined contribution plans for U.S. and non-U.S. employees. Total defined

contribution expense was $603 million in fiscal 2013, $628 million in fiscal 2012 and $626 million in

fiscal 2011. U.S. employees are automatically enrolled in the Hewlett-Packard Company 401(k) Plan

(the ‘‘HP 401(k) Plan’’) when they meet eligibility requirements, unless they decline participation.

Effective at the beginning of fiscal 2011, the quarterly employer matching contributions in the HP

401(k) Plan were set to equal 100% of an employee’s contributions, up to a maximum of 4% of eligible

compensation.

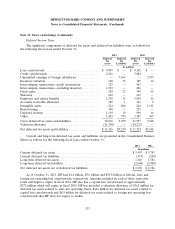

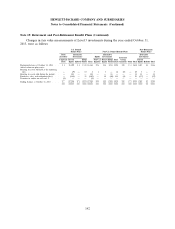

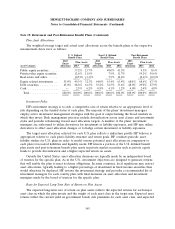

Pension and Post-Retirement Benefit Expense

HP’s net pension and post-retirement benefit cost (credit) recognized in the Consolidated

Statements of Earnings was as follows for the following fiscal years ended October 31:

U.S. Defined Non-U.S. Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

2013 2012 2011 2013 2012 2011 2013 2012 2011

In millions

Service cost ............... $ 1 $ 1 $ 1 $ 337 $294 $343 $ 6 $ 7 $ 9

Interest cost .............. 560 566 594 676 690 694 31 35 35

Expected return on plan assets . (845) (793) (744) (1,007) (816) (890) (34) (38) (37)

Amortization and deferrals:

Actuarial loss (gain) ....... 77 43 33 341 235 235 2 (3) 3

Prior service benefit .......——— (27)(24)(14)(67)(79)(83)

Net periodic benefit (credit)

cost ................... (207) (183) (116) 320 379 368 (62) (78) (73)

Curtailment (gain) loss .....——— (3) 4—(7)(30)—

Settlement loss (gain) ...... 12 11 3 18 (18) 9 — — —

Special termination benefits . — 833 — 31 17 16 (5) 227 —

Net benefit (credit) cost ...... $(195) $ 661 $(113) $ 366 $ 382 $ 393 $(74) $119 $(73)

137