HP 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

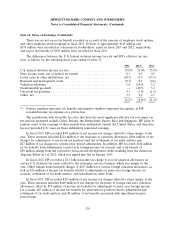

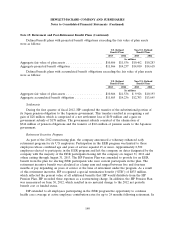

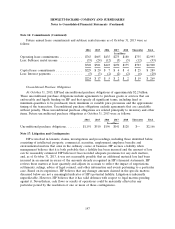

Defined benefit plans with projected benefit obligations exceeding the fair value of plan assets

were as follows:

U.S. Defined Non-U.S. Defined

Benefit Plans Benefit Plans

2013 2012 2013 2012

In millions

Aggregate fair value of plan assets ..................... $10,866 $11,536 $10,462 $10,283

Aggregate projected benefit obligation .................. $11,866 $14,237 $14,010 $14,618

Defined benefit plans with accumulated benefit obligations exceeding the fair value of plan assets

were as follows:

U.S. Defined Non-U.S. Defined

Benefit Plans Benefit Plans

2013 2012 2013 2012

In millions

Aggregate fair value of plan assets ..................... $10,866 $11,536 $ 9,926 $10,193

Aggregate accumulated benefit obligation ................ $11,865 $14,236 $12,703 $13,645

Settlements

During the first quarter of fiscal 2012, HP completed the transfer of the substitutional portion of

its Japan pension obligation to the Japanese government. This transfer resulted in recognizing a net

gain of $28 million, which is comprised of a net settlement loss of $150 million and a gain on

government subsidy of $178 million. The government subsidy consisted of the elimination of

$344 million of pension obligations and the transfer of $166 million of pension assets to the Japanese

government.

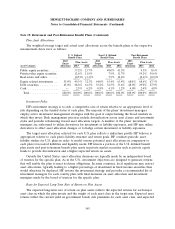

Retirement Incentive Program

As part of the 2012 restructuring plan, the company announced a voluntary enhanced early

retirement program for its U.S employees. Participation in the EER program was limited to those

employees whose combined age and years of service equaled 65 or more. Approximately 8,500

employees elected to participate in the EER program and left the company on dates designated by the

company with the majority of the EER participants having left the company on August 31, 2012 and

others exiting through August 31, 2013. The HP Pension Plan was amended to provide for an EER

benefit from the plan for electing EER participants who were current participants in the plan. The

retirement incentive benefit was calculated as a lump sum and ranged between five and fourteen

months of pay depending on years of service at the time of retirement under the program. As a result

of this retirement incentive, HP recognized a special termination benefit (‘‘STB’’) of $833 million,

which reflected the present value of all additional benefits that HP would distribute from the HP

Pension Plan. HP recorded these expenses as a restructuring charge. In addition, the HP Pension Plan

was remeasured on June 30, 2012, which resulted in no material change to the 2012 net periodic

benefit cost or funded status.

HP extended to all employees participating in the EER program the opportunity to continue

health care coverage at active employee contribution rates for up to 24 months following retirement. In

140