HP 2013 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

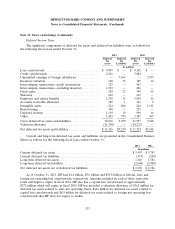

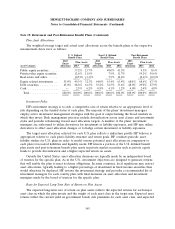

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

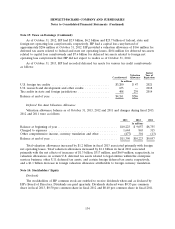

The weighted-average assumptions used to calculate net benefit (credit) cost were as follows for

the following fiscal years ended October 31:

U.S. Defined Non-U.S. Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

2013 2012 2011 2013 2012 2011 2013 2012 2011

Discount rate .................... 4.1% 4.8% 5.6% 3.8% 4.5% 4.4% 3.0% 4.4% 4.4%

Expected increase in compensation levels 2.0% 2.0% 2.0% 2.4% 2.5% 2.5% — — —

Expected long-term return on assets .... 7.8% 7.6% 8.0% 7.2% 6.4% 6.8% 9.0% 10.0% 10.5%

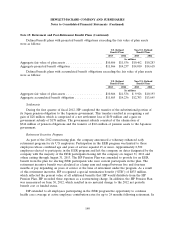

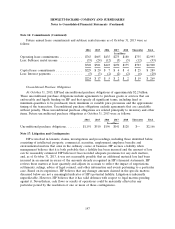

Funded Status

The funded status of the defined benefit and post-retirement benefit plans was as follows for the

following fiscal years ended October 31:

U.S. Defined Non-U.S. Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

2013 2012 2013 2012 2013 2012

In millions

Change in fair value of plan assets:

Fair value—beginning of year .......... $11,536 $10,662 $14,021 $13,180 $ 395 $ 394

Acquisition/addition of plans .......... — — 7 8 — —

Actual return on plan assets ........... 629 1,411 1,842 1,327 32 36

Employer contributions .............. 54 50 634 582 102 31

Participant contributions .............——63577259

Benefits paid ...................... (1,320) (556) (504) (462) (205) (125)

Settlement ........................ (33) (31) (96) (193) — —

Currency impact ................... — — 116 (478) — —

Fair value—end of year .............. 10,866 11,536 16,083 14,021 396 395

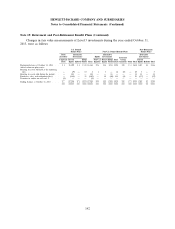

Change in benefit obligation:

Projected benefit obligation—beginning of

year ........................... 14,237 11,945 18,097 16,328 1,056 816

Acquisition/addition of plans ..........——1425——

Service cost ....................... 1 1 337 294 6 7

Interest cost ...................... 560 566 676 690 31 35

Participant contributions .............——63577259

Actuarial (gain) loss ................. (1,579) 1,479 343 2,143 (85) 34

Benefits paid ...................... (1,320) (556) (504) (462) (205) (125)

Plan amendments .................. — — 6 (67) — —

Curtailment .......................——13 5—5

Settlement ........................ (33) (31) (100) (395) — —

Special termination benefits ........... — 833 31 17 (5) 227

Currency impact ................... — — 176 (538) (3) (2)

Projected benefit obligation—end of year . . . 11,866 14,237 19,152 18,097 867 1,056

Funded status at end of year ............ $(1,000) $ (2,701) $ (3,069) $(4,076) $ (471) $ (661)

Accumulated benefit obligation .......... $11,865 $14,236 $18,254 $17,070

138