HP 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

rebates. In addition, operating expenses as a percentage of net revenue increased due primarily to the

decline in revenue coupled with increased investments in research and development, the effects of

which were partially offset by a decrease in administrative expenses.

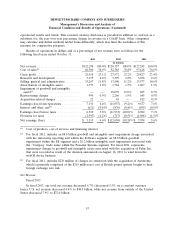

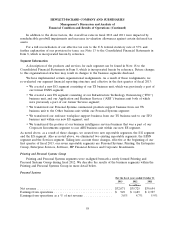

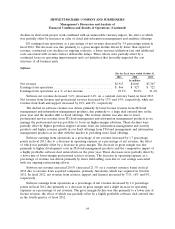

Printing

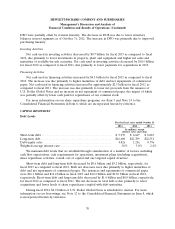

For the fiscal years ended October 31

2013 2012 2011

In millions

Net revenue ........................................... $23,854 $24,487 $26,176

Earnings from operations ................................. $ 3,890 $ 3,585 $ 3,927

Earnings from operations as a % of net revenue ................ 16.3% 14.6% 15.0%

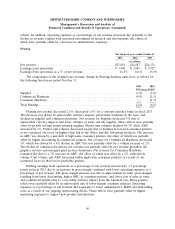

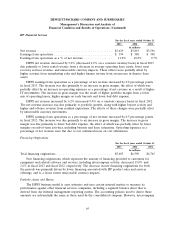

The components of the weighted net revenue change by Printing business units were as follows for

the following fiscal years ended October 31:

2013 2012

Percentage Points

Supplies ......................................................... (1.8) (3.9)

Commercial Hardware ............................................... (0.8) (1.1)

Consumer Hardware ................................................ — (1.5)

Total Printing ..................................................... (2.6) (6.5)

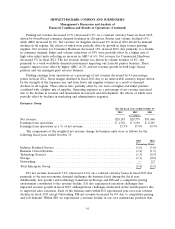

Printing net revenue decreased 2.6% (decreased 1.0% on a constant currency basis) in fiscal 2013.

The decrease was driven by unfavorable currency impacts, particularly weakness in the euro, and

declines in supplies and commercial printers. Net revenue for Supplies decreased 3% due to

unfavorable currency impacts and lower volumes of toner and ink supplies. These effects were partially

offset by growth in large format printing supplies. Printer unit volumes declined by 3% while ARU

increased by 1%. Printer unit volumes decreased largely due to declines in low-end consumer printers

as we continued our focus on higher-value Ink in the Office and Ink Advantage products. The increase

in ARU was driven by a mix shift to high-value consumer printers, the effect of which was partially

offset by higher discounting in commercial printers. Net revenue for Commercial Hardware decreased

3%, which was driven by a 6% decline in ARU that was partially offset by a volume increase of 2%.

The decline in commercial hardware net revenue was partially offset by net revenue growth in the

graphics services and managed print services businesses. Net revenue for Consumer Hardware

remained flat due to a 7% increase in ARU, the effect of which was offset by a 5% reduction in

volume. Unit volume and ARU increased within high-value consumer printers as a result of our

continued focus on those more profitable printers.

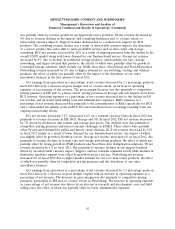

Printing earnings from operations as a percentage of net revenue increased by 1.7 percentage

points in fiscal 2013 due to an increase in gross margin combined with lower operating expenses as a

percentage of net revenue. The gross margin increase was due to improvement in toner gross margins

resulting from lower discounting, higher ARU in consumer printers, and lower cost of sales in toner

and commercial printers due to a favorable currency impact from the Japanese yen. These positive

effects were partially offset by an unfavorable mix of lower-margin consumer printers. Operating

expenses as a percentage of net revenue decreased due to lower administrative, R&D and field selling

costs as a result of our ongoing restructuring efforts. These effects were partially offset by higher

marketing expenses to support new product introductions.

60