HP 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

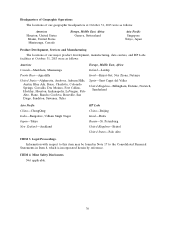

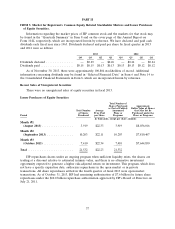

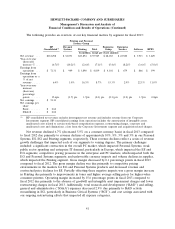

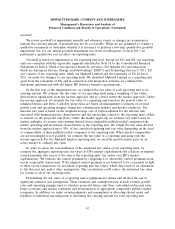

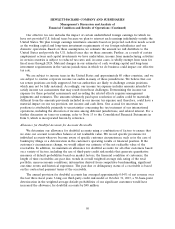

The following provides an overview of our key financial metrics by segment for fiscal 2013:

Printing and Personal

Systems Group

HP Personal Enterprise Enterprise

Consolidated(1) Systems Printing Total Group Services Software HPFS

In millions, except per share amounts

Net revenue . . . $112,298 $ 32,071 $23,854 $ 55,925 $ 28,183 $ 23,520 $ 3,913 $ 3,629

Year-over-year

(decrease)

increase % . . . (6.7)% (10.2)% (2.6)% (7.1)% (5.4)% (8.2)% (3.6)% (5.0)%

Earnings from

operations . . . $ 7,131 $ 949 $ 3,890 $ 4,839 $ 4,301 $ 679 $ 866 $ 399

Earnings from

operations as a

% of net

revenue ..... 6.4% 3.0% 16.3% 8.7% 15.3% 2.9% 22.1% 11.0%

Year-over-year

increase

(decrease)

percentage

points ...... 15.6pts (1.7) pts 1.7pts (0.1) pts (2.1) pts (1.2) pts 1.7pts 0.8pts

Net earnings . . . $ 5,113

Net earnings per

share

Basic ....... $ 2.64

Diluted ..... $ 2.62

(1) HP consolidated net revenue excludes intersegment net revenue and includes revenue from our Corporate

Investments segment. HP consolidated earnings from operations includes the amortization of intangible assets,

unallocated costs related to certain stock-based compensation expenses, restructuring charges, corporate and

unallocated costs and eliminations, a loss from the Corporate Investments segment and acquisition-related charges.

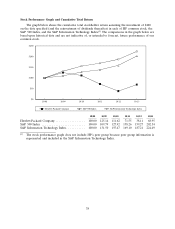

Net revenue declined 6.7% (decreased 5.5% on a constant currency basis) in fiscal 2013 compared

to fiscal 2012 due primarily to revenue declines of approximately 10%, 8%, 5% and 3% in our Personal

Systems, ES, EG and Printing segments, respectively. These revenue declines reflect a series of revenue

growth challenges that impacted each of our segments to varying degrees. The primary challenges

included: a significant contraction in the overall PC market, which impacted Personal Systems; weak

public sector spending and enterprise IT demand, particularly in Europe, which impacted the ES and

EG segments; competitive pricing pressures in the enterprise and PC markets, which impacted both the

EG and Personal Systems segments; and unfavorable currency impacts and volume declines in supplies,

which impacted the Printing segment. Gross margin decreased by 0.1 percentage points in fiscal 2013

compared to fiscal 2012. The gross margin decline was due primarily to competitive pricing

environments in the markets for EG and Personal Systems products and decreased revenue and

contractual price declines for ES. Partially offsetting these negative impacts was a gross margin increase

in Printing due primarily to improvements in toner and higher average selling prices for higher-value

consumer printers. Operating margin increased by 15.6 percentage points in fiscal 2013 compared to

fiscal 2012 due primarily to the absence of goodwill and intangible asset impairment charges and lower

restructuring charges in fiscal 2013. Additionally, total research and development (‘‘R&D’’) and selling,

general and administrative (‘‘SG&A’’) expenses decreased 2.9% due primarily to R&D activity

streamlining in EG, particularly in Business Critical Systems (‘‘BCS’’), and cost savings associated with

our ongoing restructuring efforts that impacted all expense categories.

41