HP 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

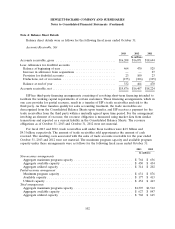

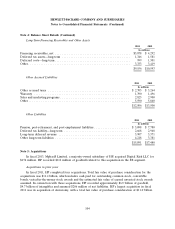

Note 4: Balance Sheet Details

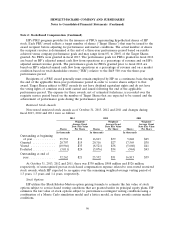

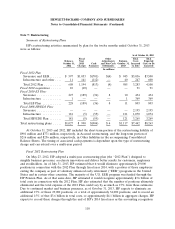

Balance sheet details were as follows for the following fiscal years ended October 31:

Accounts Receivable, Net

2013 2012 2011

In millions

Accounts receivable, gross .................................. $16,208 $16,871 $18,694

Less: Allowance for doubtful accounts

Balance at beginning of year ............................... 464 470 525

Increase in allowance from acquisitions .......................——27

Provision for doubtful accounts ............................. 23 100 23

Deductions, net of recoveries ............................... (155) (106) (105)

Balance at end of year ................................... 332 464 470

Accounts receivable, net .................................... $15,876 $16,407 $18,224

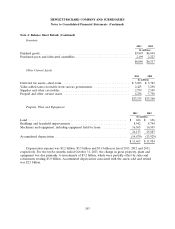

HP has third-party financing arrangements consisting of revolving short-term financing intended to

facilitate the working capital requirements of certain customers. These financing arrangements, which in

one case provides for partial recourse, result in a transfer of HP’s trade receivables and risk to the

third party. As these transfers qualify for sales accounting treatment, the trade receivables are

derecognized from the Consolidated Balance Sheets upon transfer, and HP receives a payment for the

trade receivables from the third party within a mutually agreed upon time period. For the arrangement

involving an element of recourse, the recourse obligation is measured using market data from similar

transactions and reported as a current liability in the Consolidated Balance Sheets. The recourse

obligations as of October 31, 2013 and October 31, 2012 were not material.

For fiscal 2013 and 2012, trade receivables sold under these facilities were $4.9 billion and

$4.3 billion, respectively. The amount of trade receivables sold approximates the amount of cash

received. The resulting costs associated with the sales of trade accounts receivable for the year ended

October 31, 2013 and 2012 were not material. The maximum program capacity and available program

capacity under these arrangements were as follows for the following fiscal years ended October 31:

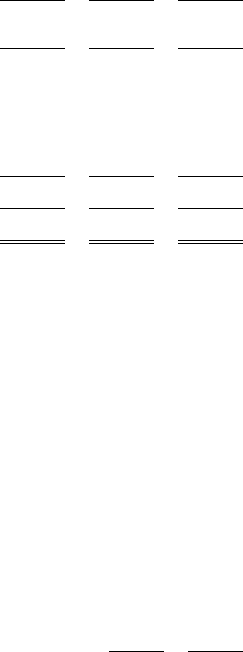

2013 2012

In millions

Non-recourse arrangements

Aggregate maximum program capacity ................................. $ 764 $ 636

Aggregate available capacity ........................................ $ 450 $ 434

Aggregate utilized capacity ......................................... $ 314 $ 202

Partial-recourse arrangement

Maximum program capacity ......................................... $ 631 $ 876

Available capacity ................................................ $ 177 $ 413

Utilized capacity ................................................. $ 454 $ 463

Total arrangements

Aggregate maximum program capacity ................................. $1,395 $1,512

Aggregate available capacity ........................................ $ 627 $ 847

Aggregate utilized capacity ......................................... $ 768 $ 665

102