HP 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

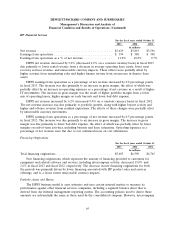

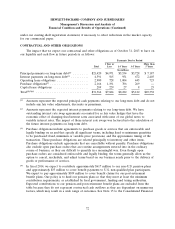

HP Financial Services

For the fiscal years ended October 31

2013 2012 2011

In millions

Net revenue .......................................... $3,629 $3,819 $3,596

Earnings from operations ................................. $ 399 $ 388 $ 348

Earnings from operations as a % of net revenue ................ 11.0% 10.2% 9.7%

HPFS net revenue decreased by 5.0% (decreased 4.2% on a constant currency basis) in fiscal 2013

due primarily to lower rental revenue from a decrease in average operating lease assets, lower asset

recovery services revenue, and unfavorable currency impacts. These effects were partially offset by

higher revenue from remarketing sales and higher finance income from an increase in finance lease

assets.

HPFS earnings from operations as a percentage of net revenue increased by 0.8 percentage points

in fiscal 2013. The increase was due primarily to an increase in gross margin, the effect of which was

partially offset by an increase in operating expenses as a percentage of net revenue as a result of higher

IT investments. The increase in gross margin was the result of higher portfolio margin from a lower

mix of operating leases, higher margin on early buyouts and lower bad debt expense.

HPFS net revenue increased by 6.2% (increased 9.0% on a constant currency basis) in fiscal 2012.

The net revenue increase was due primarily to portfolio growth, along with higher buyout activity and

higher end-of-lease revenue from residual expirations. The effects of these changes were partially offset

by unfavorable currency movements.

HPFS earnings from operations as a percentage of net revenue increased by 0.5 percentage points

in fiscal 2012. The increase was due primarily to an increase in gross margin. The increase in gross

margin was due primarily to lower bad debt expense, the effect of which was partially offset by lower

margins on end-of-term activities, including buyouts and lease extensions. Operating expenses as a

percentage of net revenue were flat due to our continued focus on cost efficiencies.

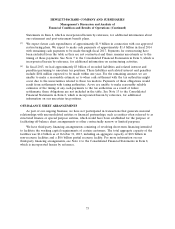

Financing Originations

For the fiscal years ended October 31

2013 2012 2011

In millions

Total financing originations ................................ $5,603 $6,590 $6,765

New financing originations, which represent the amount of financing provided to customers for

equipment and related software and services, including intercompany activity, decreased 15.0% and

2.6% in fiscal 2013 and fiscal 2012, respectively. The decrease in new financing originations for both

the periods was primarily driven by lower financing associated with HP product sales and services

offerings, and to a lesser extent unfavorable currency impacts.

Portfolio Assets and Ratios

The HPFS business model is asset intensive and uses certain internal metrics to measure its

performance against other financial services companies, including a segment balance sheet that is

derived from our internal management reporting system. The accounting policies used to derive these

amounts are substantially the same as those used by the consolidated company. However, intercompany

65