HP 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

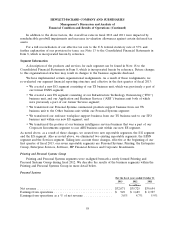

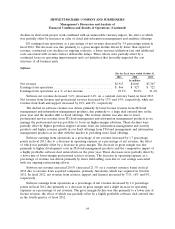

The components of the weighted net revenue change were as follows for the following fiscal years

ended October 31:

2013 2012

Percentage Points

Personal Systems .................................................. (3.0) (3.1)

Enterprise Services ................................................. (1.7) (0.5)

Enterprise Group .................................................. (1.3) (1.3)

Printing ......................................................... (0.5) (1.3)

HP Financial Services ............................................... (0.2) 0.2

Software ........................................................ (0.1) 0.5

Corporate Investments/Other ......................................... 0.1 0.1

Total HP ........................................................ (6.7) (5.4)

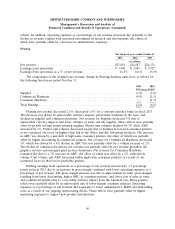

In fiscal 2013 as compared to fiscal 2012, each of our segments experienced a net revenue decline.

The leading factors contributing to the declines by segment are as follows:

• Personal Systems net revenue declined due to the contraction in the overall PC market as a

result of a customer shift, particularly consumers, to tablet products;

• ES net revenue declined due primarily to net service revenue runoff and contractual price

declines in ongoing contracts due in part to weak public sector spending and enterprise IT

demand;

• EG net revenue declined due to multiple factors, including competitive pricing challenges in

Industry Standard Servers (‘‘ISS’’), a market decline for UNIX products impacting BCS, declines

in TS due in part to lower support for BCS products, product transitions in Storage and overall

weak enterprise IT demand;

• Printing net revenue declined due to unfavorable currency impacts, particularly the euro, and

declines in supplies and commercial printers;

• HPFS net revenue decreased due primarily to lower rental revenue from a decrease in operating

lease assets; and

• Software net revenue declined due to lower license and professional services revenues from

IT/cloud management and information management products.

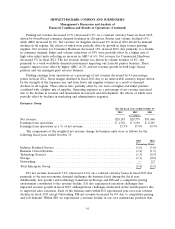

Fiscal 2012

In fiscal 2012, our total net revenue decreased 5.4% (decreased 4.4% on a constant currency

basis). U.S. net revenue decreased 4.5% to $42.1 billion, while net revenue from outside of the United

States decreased 5.9% to $78.2 billion. Our revenue decreased due primarily to a weak customer

demand environment resulting in volume declines in our hardware businesses and printing supplies

coupled with contractual rate declines on ongoing contracts in ES. Software contributed favorably to

our total net revenue change as a result of the acquisition of Autonomy in October 2011.

A more detailed discussion of segment revenue is included under ‘‘Segment Information’’ below.

54