HP 2013 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

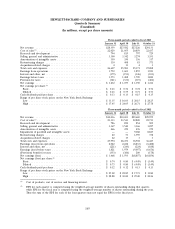

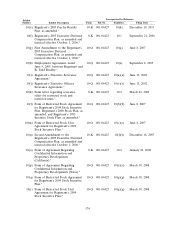

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Quarterly Summary

(Unaudited)

(In millions, except per share amounts)

Three-month periods ended in fiscal 2013

January 31 April 30 July 31 October 31

Net revenue ........................................ $28,359 $27,582 $27,226 $29,131

Cost of sales(1) ....................................... 22,029 21,055 20,859 22,437

Research and development ............................... 794 815 797 729

Selling, general and administrative .......................... 3,300 3,342 3,274 3,351

Amortization of intangible assets ........................... 350 350 356 317

Restructuring charges .................................. 130 408 81 371

Acquisition-related charges ............................... 4 11 4 3

Total costs and expenses ................................. 26,607 25,981 25,371 27,208

Earnings from operations ................................ 1,752 1,601 1,855 1,923

Interest and other, net .................................. (179) (193) (146) (103)

Earnings before taxes .................................. 1,573 1,408 1,709 1,820

Provision for taxes .................................... (341) (331) (319) (406)

Net earnings ........................................ $1,232 $ 1,077 $ 1,390 $ 1,414

Net earnings per share:(2)

Basic ............................................ $ 0.63 $ 0.56 $ 0.72 $ 0.74

Diluted .......................................... $ 0.63 $ 0.55 $ 0.71 $ 0.73

Cash dividends paid per share ............................. $ 0.13 $ 0.13 $ 0.15 $ 0.15

Range of per share stock prices on the New York Stock Exchange

Low ............................................ $11.35 $ 16.03 $ 20.15 $ 20.25

High ............................................ $17.45 $ 24.05 $ 26.71 $ 27.78

Three-month periods ended in fiscal 2012

January 31 April 30 July 31 October 31

Net revenue ........................................ $30,036 $30,693 $29,669 $29,959

Cost of sales(1) ....................................... 23,313 23,541 22,820 22,711

Research and development ............................... 786 850 854 909

Selling, general and administrative .......................... 3,367 3,540 3,366 3,227

Amortization of intangible assets ........................... 466 470 476 372

Impairment of goodwill and intangible assets ................... — — 9,188 8,847

Restructuring charges .................................. 40 53 1,795 378

Acquisition-related charges ............................... 22 17 3 3

Total costs and expenses ................................. 27,994 28,471 38,502 36,447

Earnings (loss) from operations ............................ 2,042 2,222 (8,833) (6,488)

Interest and other, net .................................. (221) (243) (224) (188)

Earnings (loss) before taxes .............................. 1,821 1,979 (9,057) (6,676)

(Provision) benefit for taxes .............................. (353) (386) 200 (178)

Net earnings (loss) .................................... $1,468 $ 1,593 $ (8,857) $ (6,854)

Net earnings (loss) per share:(2)

Basic ............................................ $ 0.74 $ 0.80 $ (4.49) $ (3.49)

Diluted .......................................... $ 0.73 $ 0.80 $ (4.49) $ (3.49)

Cash dividends paid per share ............................. $ 0.12 $ 0.12 $ 0.13 $ 0.13

Range of per share stock prices on the New York Stock Exchange

Low ............................................ $25.02 $ 22.85 $ 17.73 $ 13.80

High ............................................ $28.88 $ 30.00 $ 25.40 $ 20.26

(1) Cost of products, cost of services and financing interest.

(2) EPS for each quarter is computed using the weighted-average number of shares outstanding during that quarter,

while EPS for the fiscal year is computed using the weighted-average number of shares outstanding during the year.

Thus the sum of the EPS for each of the four quarters may not equal the EPS for the fiscal year.

165