HP 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 8: Fair Value (Continued)

value calculations for the Autonomy intangibles and the ‘‘Compaq’’ trade name were based on a

weighted average cost of capital adjusted for the relevant risk associated with those assets. The

unobservable inputs used in these valuations include projected revenue growth rates, operating margins,

royalty rates and the risk factor added to the discount rate. The discount rates ranged from 11% to

16%. Projected revenue growth rates ranged from (61)% to 13%. The (61)% rate reflected the

significant decline in expected future revenues for Compaq-branded products from fiscal 2013 to fiscal

2014 due to the change in branding strategy discussed in Note 6.

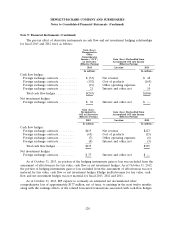

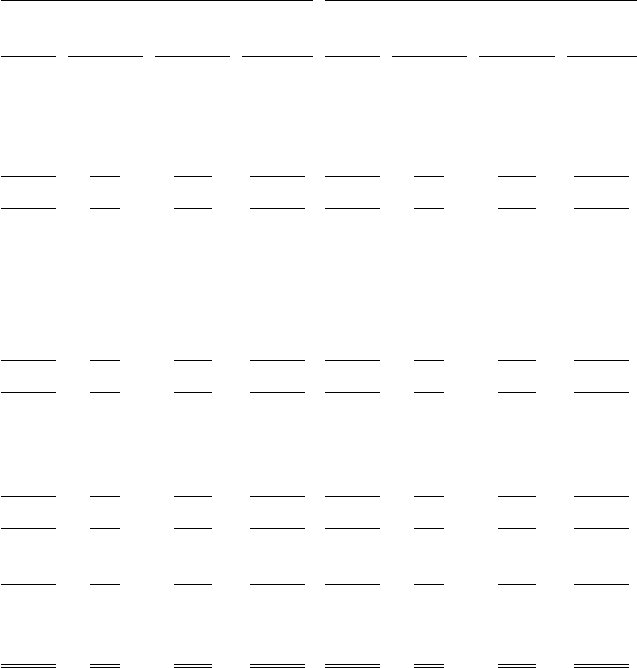

Note 9: Financial Instruments

Cash Equivalents and Available-for-Sale Investments

Cash equivalents and available-for-sale investments as of October 31, 2013 and October 31, 2012

were as follows:

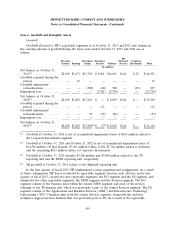

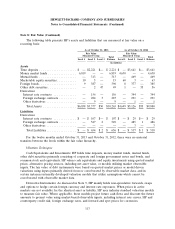

October 31, 2013 October 31, 2012

Gross Gross Gross Gross

Unrealized Unrealized Fair Unrealized Unrealized Fair

Cost Gain Loss Value Cost Gain Loss Value

In millions

Cash Equivalents

Time deposits .......... $2,207 $— $ — $2,207 $3,633 $— $ — $3,633

Money market funds ..... 6,819 — — 6,819 4,630 — — 4,630

Mutual funds .......... 13 — — 13 69 — — 69

Total cash equivalents ...... 9,039 — — 9,039 8,332 — — 8,332

Available-for-Sale

Investments

Debt securities:

Time deposits .......... 14 — — 14 8 — — 8

Foreign bonds .......... 310 86 — 396 303 82 — 385

Other debt securities ..... 64 — (15) 49 73 — (17) 56

Total debt securities ....... 388 86 (15) 459 384 82 (17) 449

Equity securities:

Mutual funds .......... 300 — — 300 400 — — 400

Equity securities in public

companies ........... 5 6 — 11 50 9 — 59

Total equity securities ...... 305 6 — 311 450 9 — 459

Total available-for-sale

investments ............ 693 92 (15) 770 834 91 (17) 908

Total cash equivalents and

available-for-sale

investments ............ $9,732 $92 $(15) $9,809 $9,166 $91 $(17) $9,240

All highly liquid investments with original maturities of three months or less at the date of

acquisition are considered to be cash equivalents. As of October 31, 2013 and 2012, the carrying value

of cash equivalents approximates fair value due to the short period of time to maturity. Interest income

115