HP 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

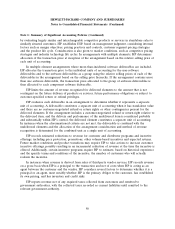

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

the discount rate used on the weighted-average cost of capital adjusted for the relevant risk associated

with business-specific characteristics and the uncertainty related to the reporting unit’s ability to execute

on the projected cash flows. Under the market approach, HP estimates fair value based on market

multiples of revenue and earnings derived from comparable publicly-traded companies with similar

operating and investment characteristics as the reporting unit. HP weights the fair value derived from

the market approach up to 50% of the concluded reporting unit fair value depending on the level of

comparability of these publicly-traded companies to the reporting unit. When market comparables are

not meaningful or not available, HP estimates the fair value of a reporting unit using only the income

approach. For the MphasiS Limited reporting unit, HP used the quoted market price in an active

market to estimate fair value.

In order to assess the reasonableness of the estimated fair values of HP’s reporting units, HP

compares the aggregate reporting unit fair values to HP’s market capitalization and calculates an

implied control premium (the excess of the sum of the reporting units’ fair values over HP’s market

capitalization). HP evaluates the control premium by comparing it to observable control premiums from

recent comparable transactions. If the implied control premium is not believed to be reasonable in light

of these recent transactions, HP reevaluates reporting unit fair values, which may result in an

adjustment to the discount rate and/or other assumptions. This reevaluation could reduce the estimated

fair value for certain or all reporting units.

If the fair value of the reporting unit exceeds the carrying amount of the net assets assigned to

that reporting unit, goodwill is not impaired and no further testing is required. If the fair value of the

reporting unit is less than its carrying amount, then HP must perform the second step of the

impairment test to measure the amount of impairment loss, if any. In the second step, HP measures

the reporting unit’s assets, including any unrecognized intangible assets, liabilities and non-controlling

interests at fair value in a hypothetical analysis to calculate the implied fair value of goodwill for the

reporting unit. If the implied fair value of the reporting unit’s goodwill is less than its carrying amount,

the difference is recorded as an impairment loss.

Intangible Assets and Long-Lived Assets

HP reviews intangible assets with finite lives and long-lived assets for impairment whenever events

or changes in circumstances indicate the carrying amount of an asset may not be recoverable. HP

assesses recoverability of the assets based on the undiscounted future cash flows expected to result

from the use of the asset and the eventual disposition of the asset. If the undiscounted future cash

flows are less than the carrying amount, the asset is impaired. HP measures the amount of impairment

loss, if any, as the difference between the carrying amount of the asset and its fair value using an

income approach or, when available and appropriate, using a market approach. HP amortizes intangible

assets with finite lives using the straight-line method over the estimated economic lives of the assets,

ranging from one to ten years.

Retirement and Post-Retirement Plans

HP has various defined benefit, other contributory and noncontributory retirement and

post-retirement plans. HP generally amortizes unrecognized actuarial gains and losses on a straight-line

basis over the average remaining estimated service life of participants. In some cases, HP amortizes

92