HP 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

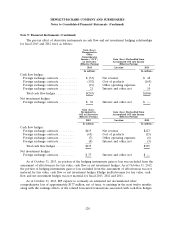

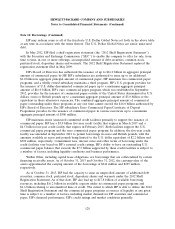

Note 9: Financial Instruments (Continued)

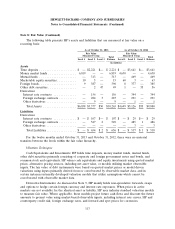

The pre-tax effect of derivative instruments not designated as hedging instruments on the

Consolidated Statements of Earnings for fiscal 2013 and 2012 were as follows:

Gain (Loss) Recognized in Income on Derivative

Location 2013

In millions

Foreign exchange contracts ..................... Interest and other, net $166

Other derivatives ............................. Interest and other, net 11

Interest rate contracts ......................... Interest and other, net 3

Total ...................................... $180

Gain (Loss) Recognized in Income on Derivative

Location 2012

In millions

Foreign exchange contracts ..................... Interest and other, net $171

Other derivatives ............................. Interest and other, net (32)

Interest rate contracts ......................... Interest and other, net 13

Total ...................................... $152

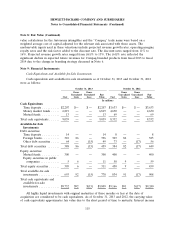

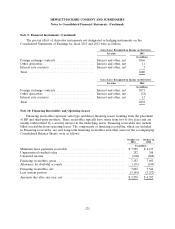

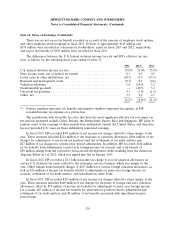

Note 10: Financing Receivables and Operating Leases

Financing receivables represent sales-type and direct-financing leases resulting from the placement

of HP and third-party products. These receivables typically have terms from two to five years and are

usually collateralized by a security interest in the underlying assets. Financing receivables also include

billed receivables from operating leases. The components of financing receivables, which are included

in Financing receivables, net and Long-term financing receivables and other assets in the accompanying

Consolidated Balance Sheets, were as follows:

October 31, October 31,

2013 2012

In millions

Minimum lease payments receivable ................................ $7,505 $ 8,133

Unguaranteed residual value ..................................... 252 248

Unearned income ............................................. (604) (688)

Financing receivables, gross ...................................... 7,153 7,693

Allowance for doubtful accounts ................................... (131) (149)

Financing receivables, net ........................................ 7,022 7,544

Less current portion ........................................... (3,144) (3,252)

Amounts due after one year, net .................................. $3,878 $ 4,292

121