HP 2013 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

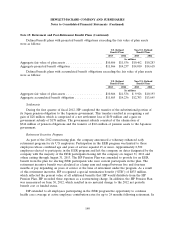

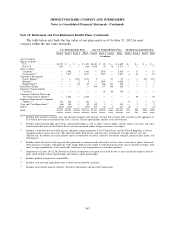

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

addition, for employees not grandfathered into certain employer-subsidized retiree medical plans, HP

provided up to $12,000 in employer credits under the RMSA. These items resulted in an additional

STB expense of $227 million, which was offset by net curtailment gains of $37 million, due primarily to

the resulting accelerated recognition of existing prior service cost/credits. The entire STB and

approximately $30 million in curtailment gains were recognized in the second half of fiscal 2012. HP

reported this net expense as a restructuring charge.

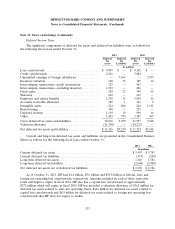

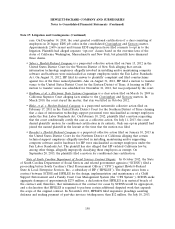

Fair Value of Plan Assets

The table below sets forth the fair value of plan assets as of October 31, 2013 by asset category

within the fair value hierarchy.

U.S. Defined Benefit Plans Non-U.S. Defined Benefit Plans Post-Retirement Benefit Plans

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

In millions

Asset Category:

Equity securities

U.S. ........................ $1,711 $ — $ — $ 1,711 $2,456 $ 31 $ — $ 2,487 $— $— $ — $ —

Non-U.S. ..................... 1,274 — — 1,274 4,059 670 77 4,806 — — — —

Debt securities

Corporate ..................... — 3,028 — 3,028 — 3,347 — 3,347 — 17 — 17

Government(1) .................. — 1,849 — 1,849 — 1,751 — 1,751 5 17 — 22

Alternative Investments

Private Equity(2) ................. — — 1,250 1,250 — 2 48 50 — — 234 234

Hybrids(3) ..................... — — 2 2 1,223 — 1,223 — — 1 1

Hedge Funds(4) .................. — — 113 113 — 226 204 430 — — — —

Real Estate Funds ................. — — — — 470 237 325 1,032 — — — —

Insurance Group Annuity Contracts ....... — — — — — 50 81 131 — — — —

Common Collective Trusts and 103-12

Investment Entities(5) .............. — 1,233 — 1,233 — — — — — 42 — 42

Registered Investment Companies (‘‘RICs’’)(6) . 61 329 — 390 — — — — 79 — — 79

Cash and Cash Equivalents(7) ........... 11 62 — 73 648 4 — 652 — 3 — 3

Other(8) ....................... (37) (20) — (57) 110 62 2 174 (2) — — (2)

Total ......................... $3,020 $6,481 $1,365 $10,866 $7,743 $7,603 $737 $16,083 $82 $79 $235 $396

(1) Includes debt issued by national, state and local governments and agencies.

(2) Includes limited partnerships and venture capital partnerships as well as equity / buyout funds, venture capital, real estate and other

similar funds that invest in the United States and internationally where foreign currencies are hedged.

(3) Includes a fund that invests in both private and public equities primarily in the United States and the United Kingdom, as well as

emerging markets across all sectors. The fund also holds fixed income and derivative instruments to hedge interest rate and inflation risk.

In addition, the fund includes units in transferable securities, collective investment schemes, money market funds, cash and deposits.

(4) Includes those that invest both long and short primarily in common stocks and credit, relative value, event driven equity, distressed debt

and macro strategies. Management of the hedge funds has the ability to shift investments from value to growth strategies, from small to

large capitalization stocks and bonds, and from a net long position to a net short position.

(5) Department of Labor 103-12 IE (Investment Entity) designation is for plan assets held by two or more unrelated employee benefit plans

which includes limited partnerships and venture capital partnerships.

(6) Includes publicly and privately traded RICs.

(7) Includes cash and cash equivalents such as short-term marketable securities.

(8) Includes international insured contracts, derivative instruments and unsettled transactions.

141