HP 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

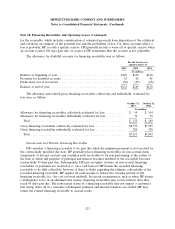

Note 10: Financing Receivables and Operating Leases (Continued)

for the receivable, which includes consideration of estimated proceeds from disposition of the collateral,

and calculates an estimate of the potential loss and the probability of loss. For those accounts where a

loss is probable, HP records a specific reserve. HP generally records a write-off or specific reserve when

an account reaches 180 days past due, or sooner if HP determines that the account is not collectible.

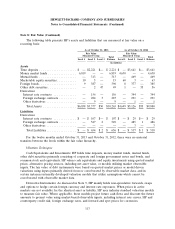

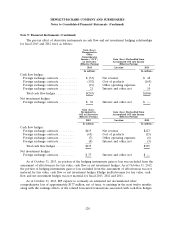

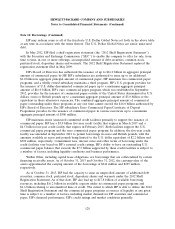

The allowance for doubtful accounts for financing receivables was as follows:

For the fiscal years

ended October 31

2013 2012 2011

In millions

Balance at beginning of year .................................. $149 $130 $140

Provision for doubtful accounts ................................ 38 42 58

Deductions, net of recoveries ................................. (56) (23) (68)

Balance at end of year ...................................... $131 $149 $130

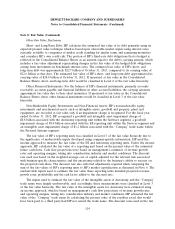

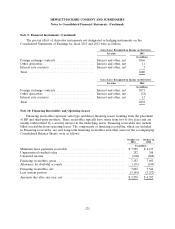

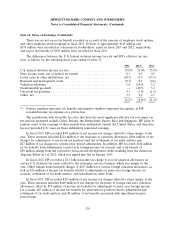

The allowance and related gross financing receivables collectively and individually evaluated for

loss were as follows:

October 31, October 31,

2013 2012

In millions

Allowance for financing receivables collectively evaluated for loss ........... $ 95 $ 104

Allowance for financing receivables individually evaluated for loss .......... 36 45

Total ..................................................... $ 131 $ 149

Gross financing receivables collectively evaluated for loss ................. $6,773 $7,355

Gross financing receivables individually evaluated for loss ................ 380 338

Total ..................................................... $7,153 $7,693

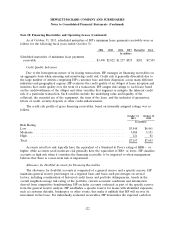

Non-Accrual and Past-due Financing Receivables

HP considers a financing receivable to be past due when the minimum payment is not received by

the contractually specified due date. HP generally places financing receivables on non-accrual status

(suspension of interest accrual) and considers such receivables to be non-performing at the earlier of

the time at which full payment of principal and interest becomes doubtful or the receivable becomes

contractually 90 days past due. Subsequently, HP may recognize revenue on non-accrual financing

receivables as payments are received (i.e., on a cash basis) if HP deems the recorded financing

receivable to be fully collectible; however, if there is doubt regarding the ultimate collectability of the

recorded financing receivable, HP applies all cash receipts to reduce the carrying amount of the

financing receivable (i.e., the cost recovery method). In certain circumstances, such as when HP deems

a delinquency to be of an administrative nature, financing receivables may accrue interest after they

reach 90 days past due. The non-accrual status of a financing receivable may not impact a customer’s

risk rating. After all of a customer’s delinquent principal and interest balances are settled, HP may

return the related financing receivable to accrual status.

123