HP 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

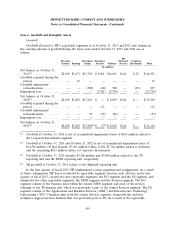

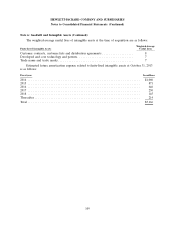

Note 6: Goodwill and Intangible Assets

Goodwill

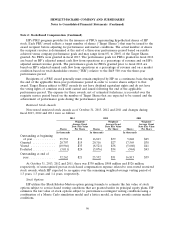

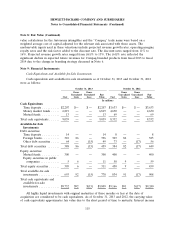

Goodwill allocated to HP’s reportable segments as of October 31, 2013 and 2012 and changes in

the carrying amount of goodwill during the fiscal years ended October 31, 2013 and 2012 are as

follows:

HP

Personal Enterprise Enterprise Financial Corporate

Systems Printing Group Services Software Services Investments Total

In millions

Net balance at October 31,

2011(1) ............... $2,498 $2,471 $17,349 $ 8,001 $14,063 $144 $ 25 $ 44,551

Goodwill acquired during the

period ............... — 16 — — — — — 16

Goodwill adjustments/

reclassifications ......... — — (308) (40) 580 — (25) 207

Impairment loss .......... — — — (7,961) (5,744) — — (13,705)

Net balance at October 31,

2012(2) ............... $2,498 $2,487 $17,041 $ — $ 8,899 $144 $ — $ 31,069

Goodwill acquired during the

period ............... — — — 112 — — — 112

Goodwill adjustments/

reclassifications ......... — — 39 (15) (81) — — (57)

Impairment loss .......... — — — — — — — —

Net balance at October 31,

2013(2) ............... $2,498 $2,487 $17,080(3) $97

(4)$ 8,818 $144 $ — $ 31,124

(1) Goodwill at October 31, 2011 is net of accumulated impairment losses of $813 million related to

the Corporate Investments segment.

(2) Goodwill at October 31, 2013 and October 31, 2012 is net of accumulated impairment losses of

$14,518 million. Of that amount, $7,961 million relates to ES, $5,744 million relates to Software,

and the remaining $813 million relates to Corporate Investments.

(3) Goodwill at October 31, 2013 includes $9,280 million and $7,800 million related to the TS

reporting unit and the ESSN reporting unit, respectively.

(4) All goodwill at October 31, 2013 relates to the MphasiS reporting unit.

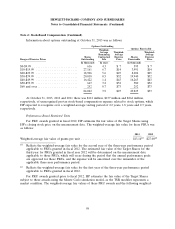

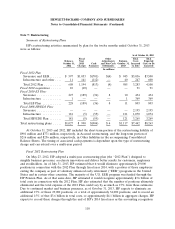

In the first quarter of fiscal 2013, HP implemented certain organizational realignments. As a result

of these realignments, HP has re-evaluated its reportable segment structure and, effective in the first

quarter of fiscal 2013, created two new reportable segments, the EG segment and the ES segment, and

eliminated two other reportable segments, the ESSN segment and the Services segment. The EG

segment consists of the business units within the former ESSN segment and most of the services

offerings of the TS business unit, which was previously a part of the former Services segment. The ES

segment consists of the Applications and Business Services (‘‘ABS’’) and Infrastructure Technology

Outsourcing (‘‘ITO’’) business units from the former Services segment, along with the end-user

workplace support services business that was previously part of TS. As a result of the reportable

105