Delta Airlines 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

NOTE 5. GOODWILL AND OTHER INTANGIBLE ASSETS

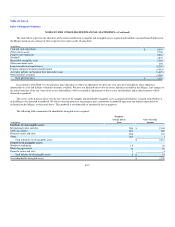

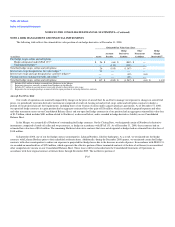

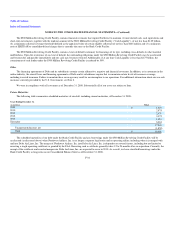

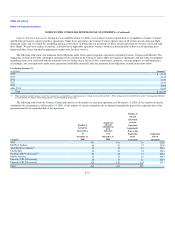

The following table reflects the change in the carrying amount of goodwill for the year ended December 31, 2008:

(in millions) Total

Balance at December 31, 2007 $ 12,104

Impairment charge (6,939)

Northwest Merger 4,572

Other (6)

Balance at December 31, 2008 $ 9,731

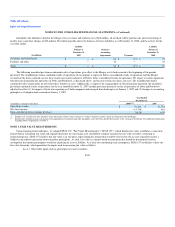

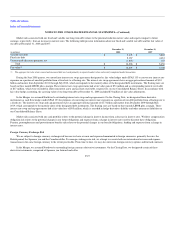

During the March 2008 quarter, we experienced a significant decline in market capitalization driven primarily by record fuel prices and overall airline

industry conditions. In addition, the announcement of our intention to merge with Northwest established a stock exchange ratio based on the relative valuation

of Delta and Northwest (see Note 2). We determined that these factors combined with further increases in fuel prices were an indicator that a goodwill

impairment test was required pursuant to SFAS 142. As a result, we estimated fair value based on a discounted projection of future cash flows, supported with

a market-based valuation. We determined that goodwill was impaired and recorded a non-cash charge of $6.9 billion for the year ended December 31, 2008.

In estimating fair value, we based our estimates and assumptions on the same valuation techniques employed and levels of inputs used to estimate the fair

value of goodwill upon adoption of fresh start reporting.

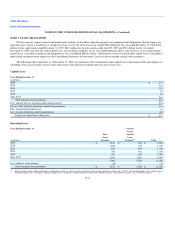

In addition to the goodwill impairment charge, we recorded a non-cash charge of $357 million ($238 million after tax) for the year ended December 31,

2008 to reduce the carrying value of certain intangible assets based on their revised estimated fair values. This charge was included in impairment of goodwill

and other intangible assets on our Consolidated Statement of Operations for the year ended December 31, 2008. The following tables reflect the changes in

the carrying amount of intangible assets at December 31, 2008:

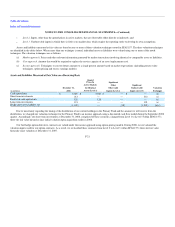

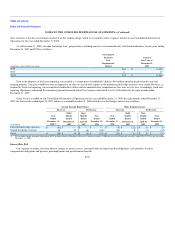

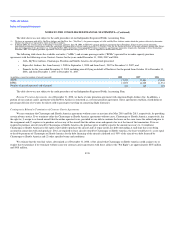

Indefinite-Lived Intangible Assets

(in millions)

Carrying

Amount

December 31,

2007 Impairment

Acquired

in

Northwest

Merger

Carrying

Amount

December 31,

2008

International routes and slots $ 195 $ (35) $ 2,140 $ 2,300

Delta tradename 880 (30) — 850

SkyTeam alliance(1) 480 (199) 380 661

Domestic routes and slots 440 (50) 110 500

Other 2 — 1 3

Total $ 1,997 $ (314) $ 2,631 $ 4,314

(1) As a result of fresh start reporting upon emergence from bankruptcy, we recorded a $480 million indefinite-lived intangible asset associated with our membership in SkyTeam, a global

airline alliance, which includes Northwest, that permits carriers to retain their separate identities and route networks while increasing the number of domestic and international connecting

passengers using the carriers' route networks. In connection with the impairment analysis performed during the June 2008 quarter, we recorded a non-cash charge of $199 million related

to our SkyTeam alliance to reduce the carrying values to their revised estimated fair values. Included within this amount is $103 million associated with the portion of our SkyTeam

alliance agreements that is directly attributable to Northwest.

F-29