Delta Airlines 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

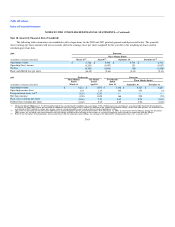

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

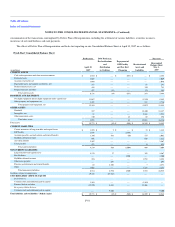

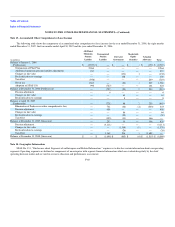

(2) For the eight months ended December 31, 2007, we excluded from our earnings per share calculation options to purchase approximately three million shares of common stock because

their effect was anti-dilutive.

(3) Upon emergence from bankruptcy, we discharged our liabilities subject to compromise, which included convertible debt. As a result, we recognized a gain of $216 million for the four

months ended April 30, 2007. In connection with this discharge, 37 million shares of common stock were assumed issued for purposes of calculating diluted earnings per share.

(4) For the year ended December 31, 2006, we excluded from our loss per share calculation all common stock equivalents because their effect was anti-dilutive. These common stock

equivalents include (1) stock options and preferred stock through the dates of their cancellation and conversion during our bankruptcy proceedings and (2) shares of common stock

issuable upon conversion of our convertible debt. These common stock equivalents totaled 37 million shares for the year ended December 31, 2006.

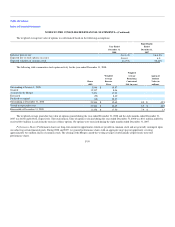

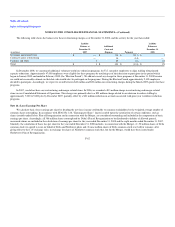

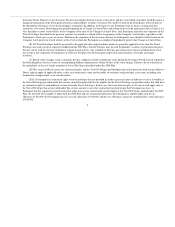

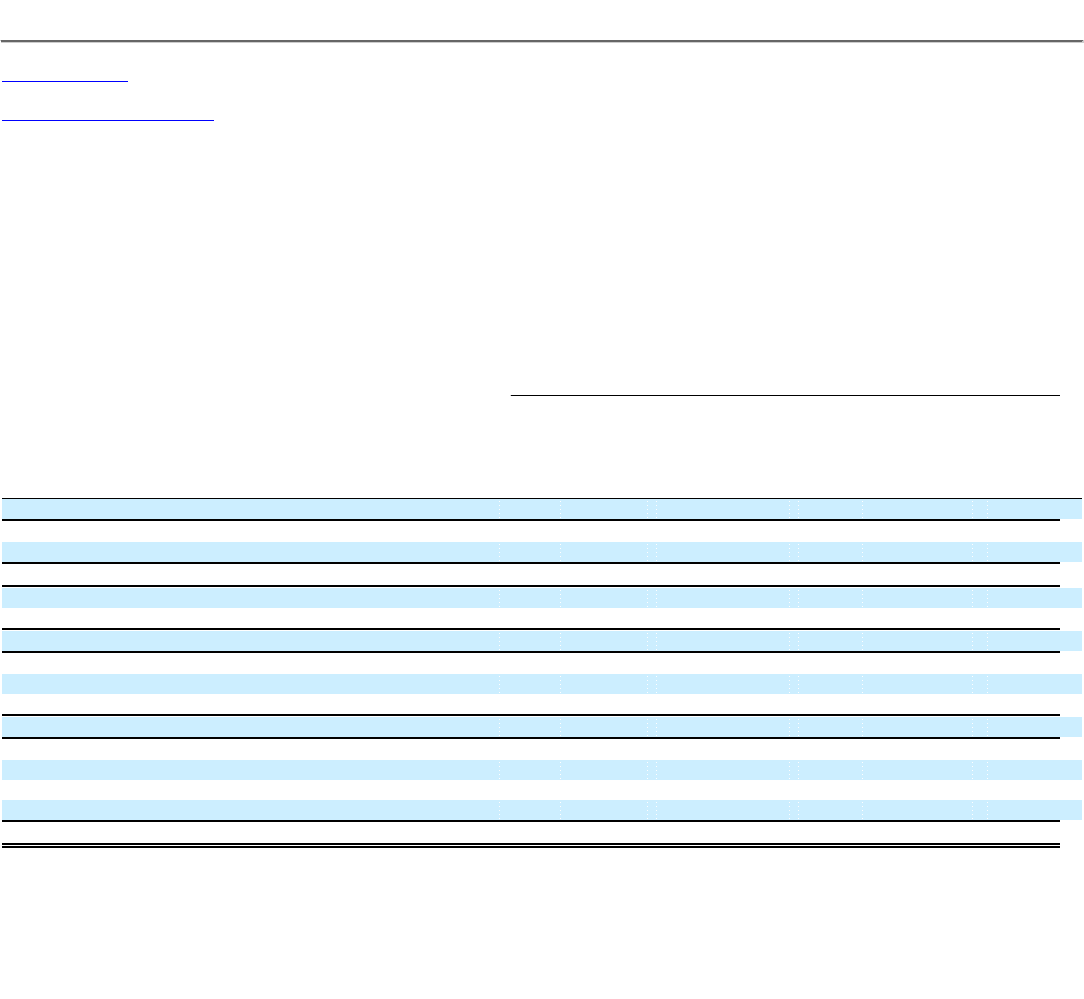

Note 17. Valuation and Qualifying Accounts

The following table shows our valuation and qualifying accounts for the year ended December 31, 2008, the eight months ended December 31, 2007,

the four months ended April 30, 2007 and the year ended 2006, and the associated activity for the years then ended:

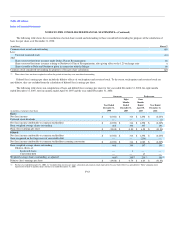

Allowance for:

(in millions)

Restructuring

and Other

Charges(1)

Uncollectible

Accounts

Receivable(2)

Obsolescence of

Expendable

Parts &

Supplies

Inventory

Deferred

Tax

Assets

Balance at January 1, 2006 (Predecessor) $ 84 $ 41 $ 201 $ 3,954(3)

Additional costs and expenses 32 16 12 2,749

Payments and deductions (111) (36) (52) (1,534)

Balance at December 31, 2006 (Predecessor) 5 21 161 5,169(4)

Additional costs and expenses 1 5 13 1,092

Payments and deductions (2) (5) (43) (1,201)

Balance at April 30, 2007 (Predecessor) 4 21 131 5,060(4)

Valuation adjustment — — (131) (230)

Additional costs and expenses — 15 11 669

Payments and deductions (1) (10) — (656)

Balance at December 31, 2007 (Successor) 3 26 11 4,843(5)

Liabilities assumed from Northwest — 6 — 3,389

Purchase accounting adjustments 94 — — 184

Additional costs and expenses 153 31 23 1,866

Payments and deductions (146) (21) (2) (452)

Balance at December 31, 2008 (Successor) $ 104 $ 42 $ 32 $ 9,830(6)

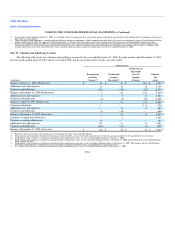

(1) Primarily related to severance and related costs, restructuring of facility leases and other charges.

(2) The payments and deductions related to the allowance for uncollectible accounts receivable represent the write-off of accounts considered to be uncollectible, less recoveries.

(3) $170 million of this amount is recorded in accumulated other comprehensive loss on our Consolidated Balance Sheet at January 1, 2006.

(4) $230 million of this amount is recorded in accumulated other comprehensive loss on our Consolidated Balance Sheet at December 31, 2006 and our Fresh Start Consolidated Balance

Sheet at April 30, 2007.

(5) $166 million of this amount is recorded in accumulated other comprehensive income on our Consolidated Balance Sheet at December 31, 2007. This balance reflects a $230 million

write-off recorded upon the adoption of fresh start reporting to eliminate the Predecessor's accumulated other comprehensive loss.

(6) $1.5 billion of this amount is recorded in accumulated other comprehensive loss on our Consolidated Balance Sheet at December 31, 2008.

F-64