Delta Airlines 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Restricted Stock. Restricted stock is common stock that may not be sold or otherwise transferred for a period of time and that is subject to forfeiture in

certain circumstances. The fair value of the restricted stock awards is based on the closing price of the common stock on the date of grant. In connection with

the Merger, we granted 17 million shares of restricted stock, which, subject to the employee's continued employment, vest over three years in four

installments (20% on May 1, 2009, 20% on November 1, 2009, 20% on May 1, 2010, and 40% on November 1, 2011). Upon emergence from Chapter 11, we

granted eight million shares of restricted stock to eligible employees. Substantially all of these awards, to the extent not previously vested, vested upon the

closing of the Merger. We expect substantially all unvested restricted stock awards at December 31, 2008 to vest during the vesting period.

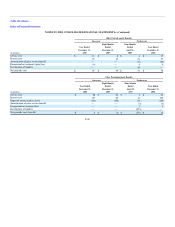

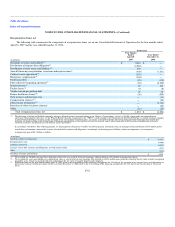

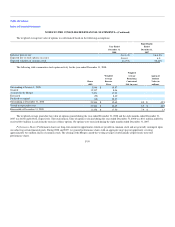

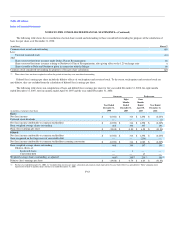

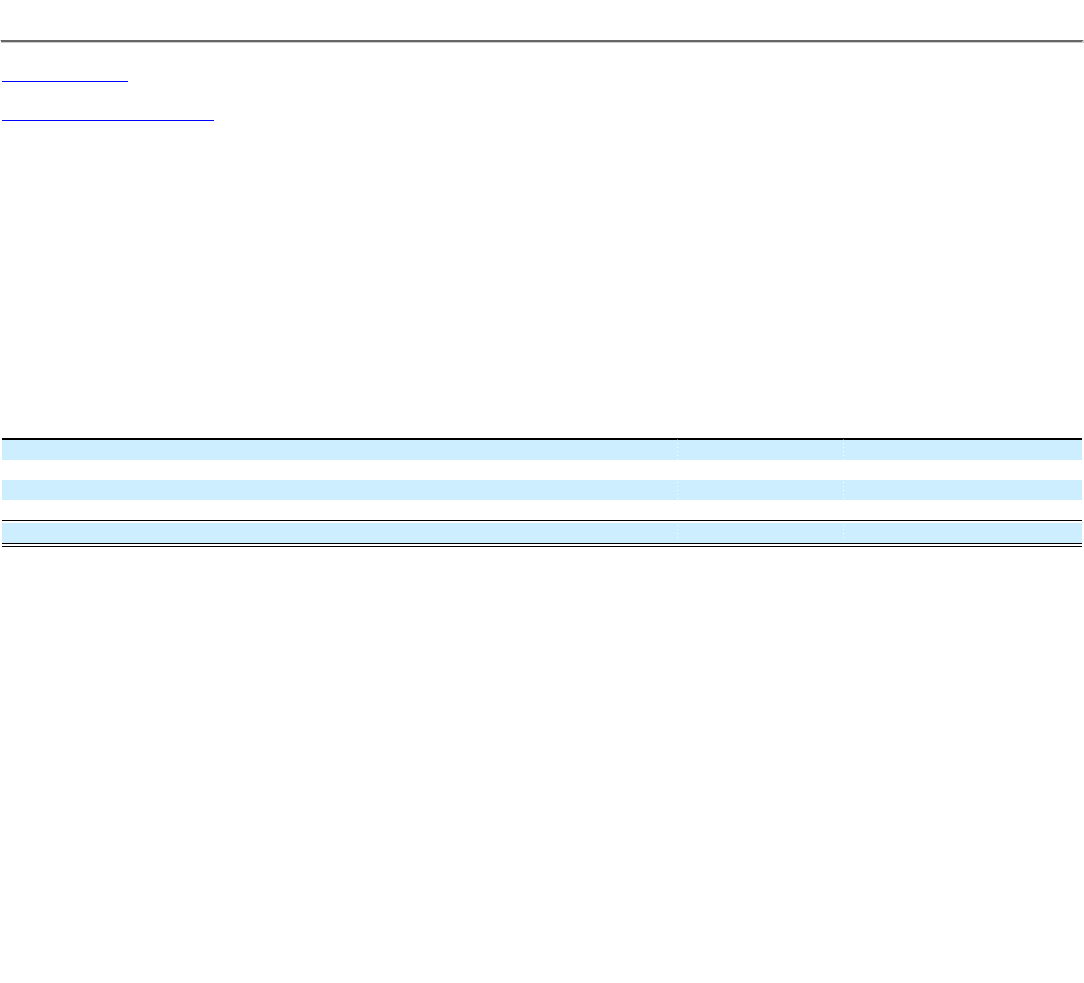

The following table summarizes restricted stock activity for the year ended December 31, 2008:

Shares

(000)

Weighted

Average

Grant Date

Fair Value

Unvested at January 1, 2008 5,195 $ 20.11

Granted 18,248 8.04

Vested (5,720) 18.67

Forfeited (73) 18.97

Unvested at December 31, 2008 17,650 $ 8.11

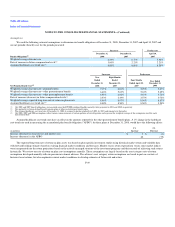

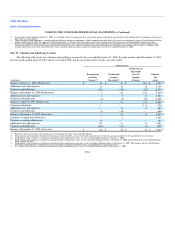

Stock Options. Stock option awards are granted with an exercise price equal to the closing price of Delta common stock on the date of grant. Generally,

outstanding employee options vest over several years and have a 10-year term, subject to the employee's continued employment.

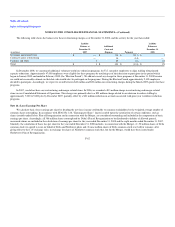

The fair value of stock options is determined at the grant date using an options pricing model based on several assumptions. The risk-free rate is based

on the U.S. Treasury yield in effect for the expected term of the options at the time of grant. The dividend yield on our common stock is assumed to be zero

since we do not pay dividends and have no current plans to do so. Due to the impact of our Chapter 11 proceedings, our historical volatility data and employee

stock option exercise patterns were not considered in determining the volatility and expected life assumptions. Prior to the Merger, volatility assumptions

were based on (1) historical volatilities of the stock of comparable airlines whose shares are traded using daily stock price returns equivalent to the expected

term of the options and (2) implied volatilities. We no longer consider implied volatilities in setting our expected volatility assumptions, as we believe due to

current market conditions implied volatility is no longer a reasonable indicator of future volatility of Delta common stock. The expected life of the options

was developed using the simplified assumption that the option will be exercised evenly from the time it becomes exercisable to expiration, as allowed by Staff

Accounting Bulletin No. 107, "Share Based Payments."

In connection with the Merger, we granted stock options to purchase 12 million shares of common stock. These options become exercisable in four

installments (20% on May 1, 2009, 20% on November 1, 2009, 20% on May 1, 2010, and 40% on November 1, 2011), subject to the employee's continued

employment. Upon emergence from Chapter 11, we granted options to purchase four million shares of common stock to eligible employees. Substantially all

of these awards, to the extent not previously exercisable, became exercisable upon the closing of the Merger. Pursuant to the Merger Agreement, outstanding

stock options under the Northwest 2007 Stock Incentive Plan were assumed by Delta and modified to provide for the purchase of Delta common stock.

Accordingly, the number of shares and the exercise price were adjusted for the 1.25 exchange ratio.

F-58