Delta Airlines 2008 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

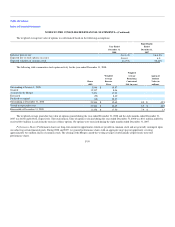

We are managed as a single business unit that provides air transportation for passengers and cargo. This allows us to benefit from an integrated revenue

pricing and route network. Our flight equipment forms one fleet, which is deployed through a single route scheduling system. When making resource

allocation decisions, our chief operating decision maker evaluates flight profitability data, which considers aircraft type and route economics, but gives no

weight to the financial impact of the resource allocation decision on an individual carrier basis. Our objective in making resource allocation decisions is to

optimize our consolidated financial results.

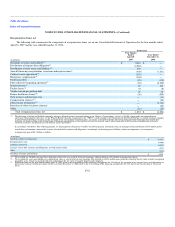

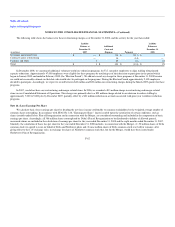

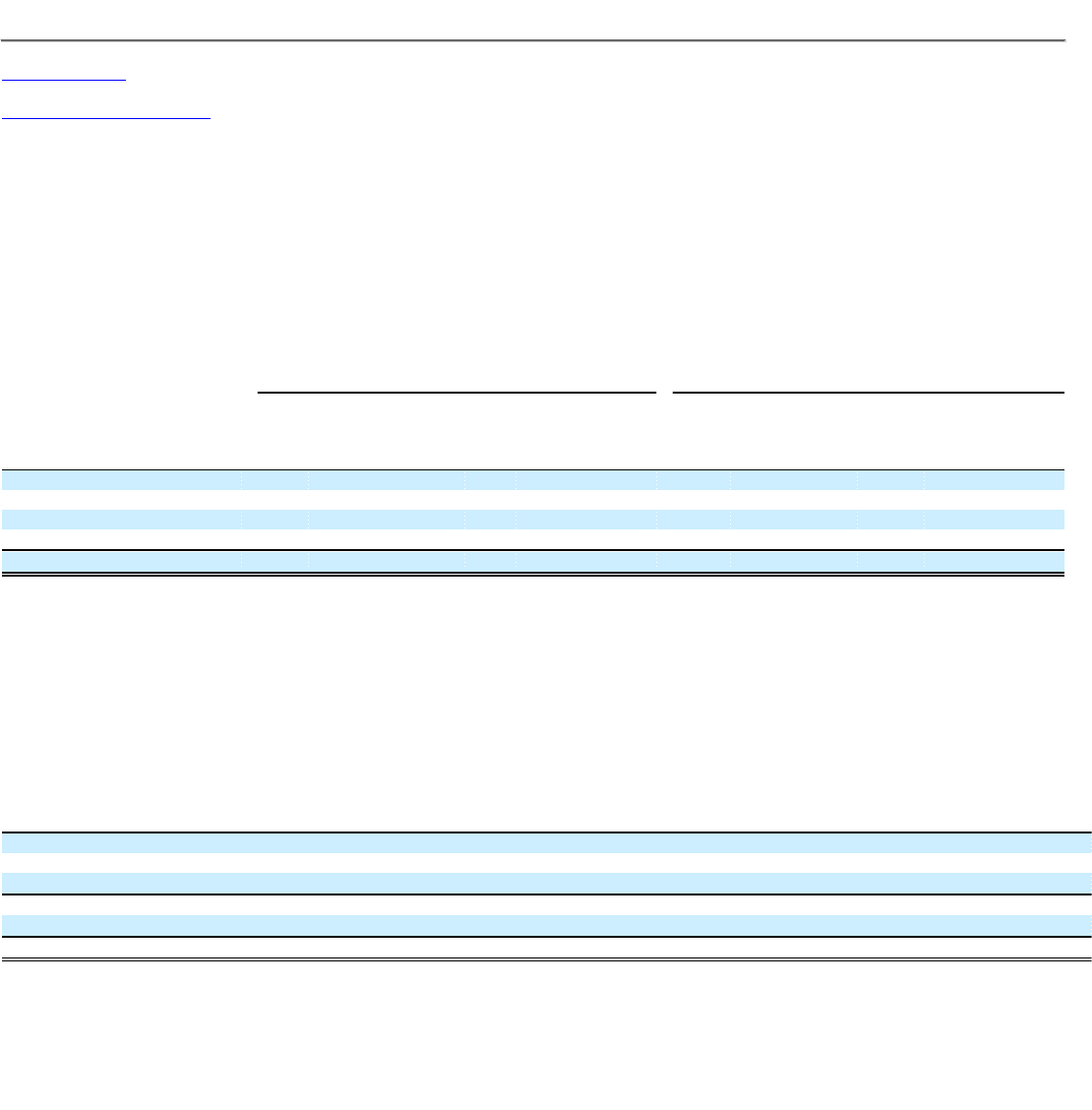

Operating revenue is assigned to a specific geographic region based on the origin, flight path and destination of each flight segment. Our operating

revenue by geographic region for the year ended December 31, 2008, the eight months ended December 31, 2007, the four months ended April 30, 2007 and

the year ended December 31, 2006 are summarized in the following table:

Successor Predecessor

(in millions)

Year Ended

December 31,

2008

Eight Months

Ended

December 31,

2007

Four Months

Ended

April 30,

2007

Year Ended

December 31,

2006

North America $ 15,065 $ 9,380 $ 4,314 $ 13,204

Atlantic 5,149 2,884 947 3,058

Latin America 1,616 923 478 1,102

Pacific 867 171 57 168

Total $ 22,697 $ 13,358 $ 5,796 $ 17,532

Our tangible assets consist primarily of flight equipment, which is mobile across geographic markets. Accordingly, assets are not allocated to specific

geographic regions.

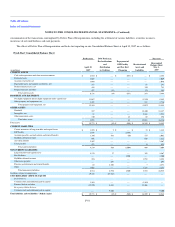

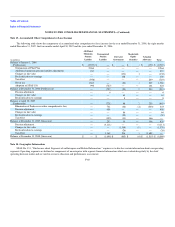

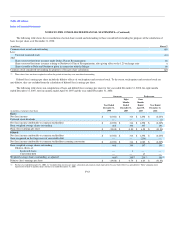

Note 15. Restructuring and Merger-Related Items

The following table shows charges recorded in restructuring and merger-related items on our Consolidated Statement of Operations for the year ended

December 31, 2008:

(in millions)

Year

Ended

December 31,

2008

Severance and related costs(1) $ 114

Contract Carrier restructuring(2) 14

Facilities and other(3) 25

Total restructuring 153

Merger-related items(4) 978

Total restructuring and merger-related items $ 1,131

(1) Relates to two voluntary workforce reduction programs for U.S. non-pilot employees announced in March 2008 in which approximately 4,200 employees elected to participate. These

programs were intended to align staffing with planned capacity reductions.

(2) Relates to the early termination of certain capacity purchase agreements with our Contract Carriers.

(3) Primarily relates to the closing of operations in Concourse C at the Cincinnati Airport. Upon our exit from Concourse C, we recorded a one-time charge of $18 million based on the

estimated present value of future rents.

(4) Includes a one-time primarily non-cash charge of $907 million relating to the issuance or vesting of employee equity awards in connection with the Merger.

F-61