Delta Airlines 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

Northwest Pension Plans are based on various assumptions concerning factors outside our control, including, among other things, the market performance of

assets; statutory requirements; and demographic data for participants, including the number of participants and the rate of participant attrition. Results that

vary significantly from our assumptions could have a material impact on our future funding obligations.

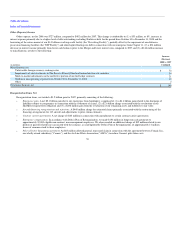

We estimate that the funding requirements for the Delta Non-Pilot Plan and the Northwest Pension Plans will total approximately $275 million in 2009.

Due primarily to the recent decline in the investment markets, we expect our contributions to these plans to significantly increase for 2010 and thereafter.

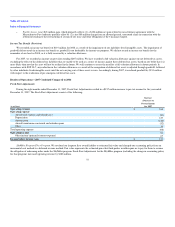

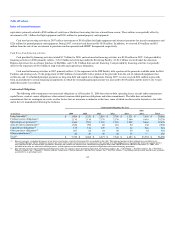

Contract Carrier Agreements. During the year ended December 31, 2008, seven regional air carriers ("Contract Carriers") operated for us (in addition

to our wholly-owned subsidiaries, Comair, Inc. ("Comair"), Compass Airlines, Inc. ("Compass") and Mesaba Aviation, Inc. ("Mesaba")) pursuant to capacity

purchase agreements. Under these agreements, the regional air carriers operate some or all of their aircraft using our flight designator codes, and we control

the scheduling, pricing, reservations, ticketing and seat inventories of those aircraft and retain the revenues associated with those flights. We pay those airlines

an amount, as defined in the applicable agreement, which is based on a determination of their cost of operating those flights and other factors intended to

approximate market rates for those services.

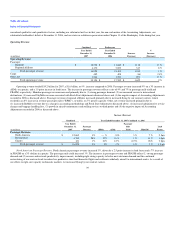

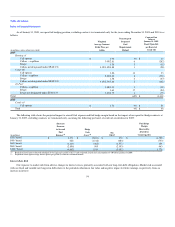

The above table shows our minimum fixed obligations under these capacity purchase agreements (excluding Comair, Compass and Mesaba). The

obligations set forth in the table contemplate minimum levels of flying by the Contract Carriers under the respective agreements and also reflect assumptions

regarding certain costs associated with the minimum levels of flying such as for fuel, labor, maintenance, insurance, catering, property tax and landing fees.

Accordingly, our actual payments under these agreements could differ materially from the minimum fixed obligations set forth in the table above.

For information regarding payments we may be required to make in connection with certain terminations of our capacity purchase agreements with

Chautauqua and Shuttle America, see "Contingencies Related to Termination of Contract Carrier Agreements" in Note 8 of the Notes to the Consolidated

Financial Statements.

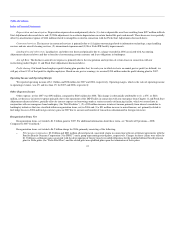

FIN 48. We adopted FASB Interpretation No. 48, "Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement No. 109," on

January 1, 2007. The total amount of unrecognized tax benefits on the Consolidated Balance Sheet at December 31, 2008 is $29 million. We have accrued $5

million for the payment of interest and $8 million for the payment of penalties related to these unrecognized tax benefits.

We are currently under audit by the Internal Revenue Service for the 2005 through 2007 tax years. The audit is substantially complete and is expected

to close in early 2009.

Legal Contingencies. We are involved in various legal proceedings relating to employment practices, environmental issues and other matters

concerning our business. We cannot reasonably estimate the potential loss for certain legal proceedings because, for example, the litigation is in its early

stages or the plaintiff does not specify the damages being sought.

Other Contingent Obligations under Contracts. In addition to the contractual obligations discussed above, we have certain contracts for goods and

services that require us to pay a penalty, acquire inventory specific to us or purchase contract specific equipment, as defined by each respective contract, if we

terminate the contract without cause prior to its expiration date. Because these obligations are contingent on our termination of the contract without cause

prior to its expiration date, no obligation would exist unless such a termination occurs.

For additional information about other contingencies not discussed above, as well as information related to general indemnifications, see Note 8 of the

Notes to the Consolidated Financial Statements.

46