Delta Airlines 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

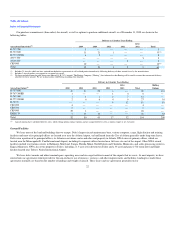

Merger Synergies

As discussed above, we expect to generate significant synergies from the Merger. Our key early integration efforts will focus on (1) technology,

(2) employees, (3) standardizing our fleet across the two airlines and (4) achieving a single operating certificate.

We believe that we will recognize $500 million in synergy benefits in 2009, primarily in the second half of the year. Our ability to realize the synergies

will depend, among other things, on our successfully aligning technologies of the two airlines, receiving a single operating certificate and resolving labor

representation differences while maintaining productive employee relations.

We have made significant progress regarding integration of our workgroups, including reaching joint collective bargaining agreements and integrated

seniority lists with our pilots and flight dispatchers and reaching agreement on a seniority list with our meteorologists. Recently, the NMB accepted a request

by the Aircraft Mechanics Fraternal Association ("AMFA") to terminate AMFA's certification to represent pre-merger NWA aircraft maintenance technicians

and related employees, which will allow us to integrate these workgroups promptly. In addition, the Delta flight attendant seniority committee has reached a

position on a combined seniority list that we believe is consistent with the position of the Association of Flight Attendants ("AFA"), which was certified to

represent the NWA flight attendants prior to the merger. The integration of some portions of the rest of the Delta and NWA workforces may be challenging in

part because representation and seniority integration issues must be resolved and two of the unions, the AFA and the International Association of Machinists

and Aerospace Workers, which represents NWA's airport employees and other categories of ground employees, have not said when they will seek to proceed

to resolve those issues.

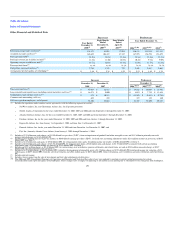

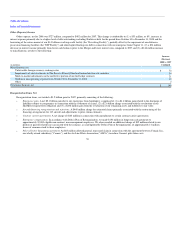

Background and Combined Financial Results of the Predecessor and Successor

In September 2005, we and substantially all of our subsidiaries (the "Delta Debtors") filed voluntary petitions for reorganization under Chapter 11 of

the U.S. Bankruptcy Code (the "Bankruptcy Code"). On April 30, 2007 (the "Effective Date"), the Delta Debtors emerged from bankruptcy. References in this

Form 10-K to "Successor" refer to Delta on or after May 1, 2007, after giving effect to (1) the cancellation of Delta common stock issued prior to the Effective

Date; (2) the issuance of new Delta common stock and certain debt securities in accordance with the Delta Debtors' Joint Plan of Reorganization ("Delta's

Plan of Reorganization"); and (3) the application of fresh start reporting. References to "Predecessor" refer to Delta prior to May 1, 2007.

Upon emergence from Chapter 11, we adopted fresh start reporting in accordance with American Institute of Certified Public Accountants' Statement of

Position 90-7, "Financial Reporting by Entities in Reorganization under the Bankruptcy Code" ("SOP 90-7"). The adoption of fresh start reporting resulted in

our becoming a new entity for financial reporting purposes. Due to our adoption of fresh start reporting on April 30, 2007, the accompanying Consolidated

Statements of Operations include the results of operations for (1) the year ended December 31, 2008 of the Successor, (2) the eight months ended

December 31, 2007 of the Successor, (3) the four months ended April 30, 2007 of the Predecessor and (4) the year ended December 31, 2006 of the

Predecessor.

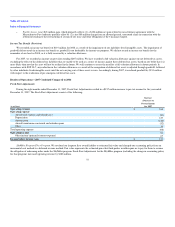

For purposes of management's discussion and analysis of the results of operations in this Form 10-K, we combined the results of operations for the four

months ended April 30, 2007 of the Predecessor with the eight months ended December 31, 2007 of the Successor. We then compare (1) Delta's results of

operations for the year ended December 31, 2008 with the 2007 combined results and (2) the 2007 combined results with the Predecessor's results of

operations for the year ended December 31, 2006. We also discuss significant fresh start reporting adjustments ("Fresh Start Adjustments"), which impacted

comparability.

We believe the 2007 combined results of operations provide management and investors with a more meaningful perspective on Delta's financial and

operational performance than if we did not combine the results of operations of the Predecessor and the Successor in this manner. Similarly, we combine the

financial results of the Predecessor and the Successor when discussing our sources and uses of cash for the year ended December 31, 2007.

32