Delta Airlines 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

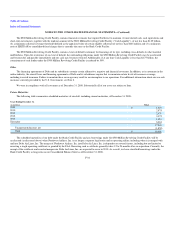

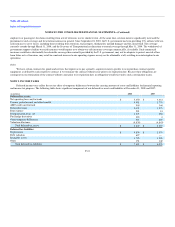

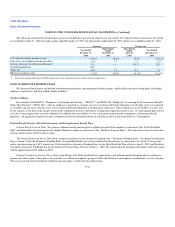

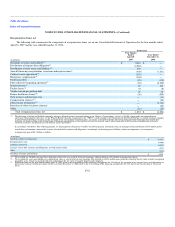

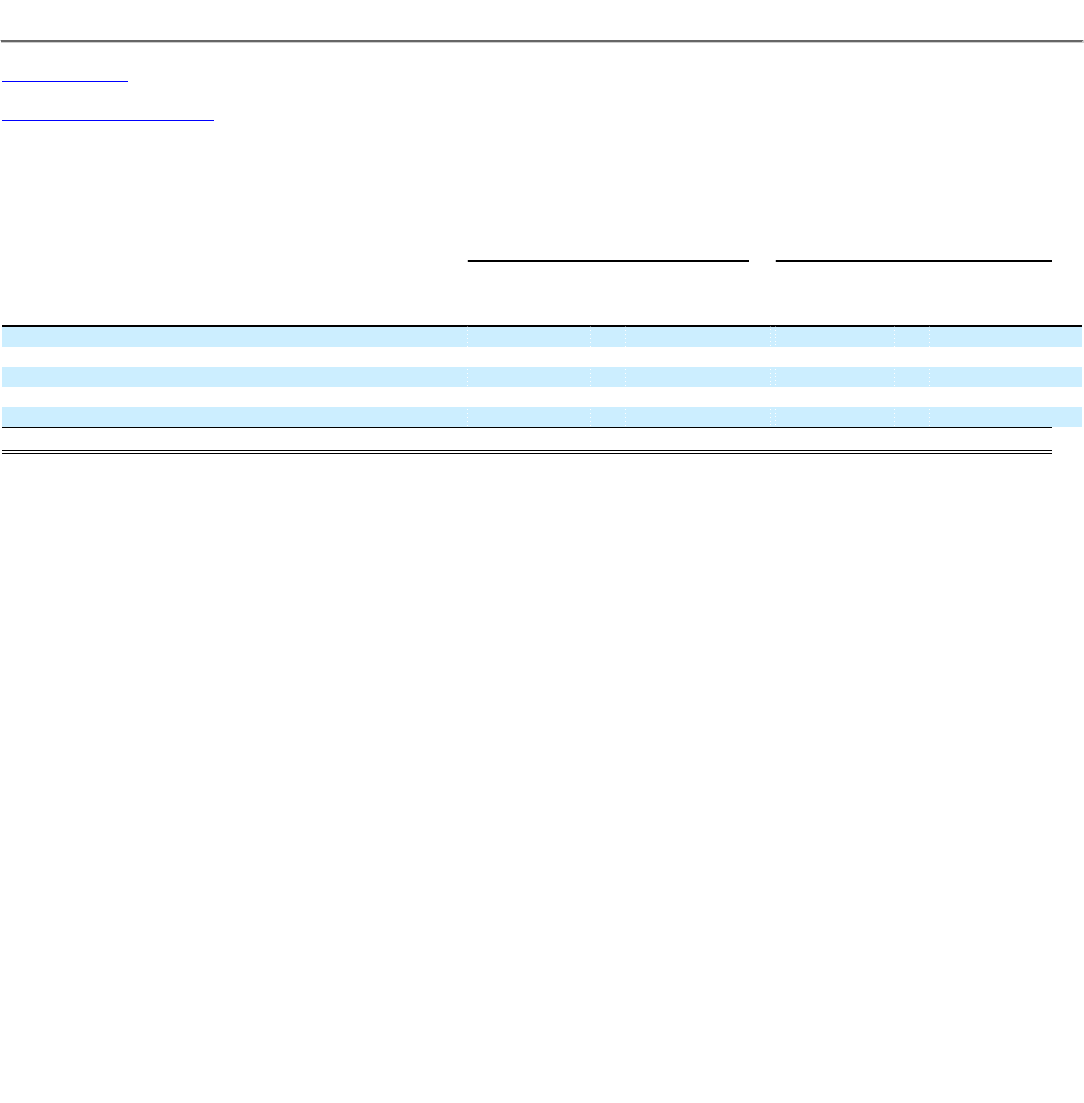

The following table presents the principal reasons for the difference between the effective tax rate and the U.S. federal statutory income tax rate for the

year ended December 31, 2008, the eight months ended December 31, 2007, the four months ended April 30, 2007 and the year ended December 31, 2006:

Successor Predecessor

Year Ended

December 31,

2008

Eight Months

Ended

December 31,

2007

Four Months

Ended

April 30,

2007

Year Ended

December 31,

2006

U.S. federal statutory income tax rate (35.0)% 35.0% 35.0% (35.0)%

State taxes, net of federal income tax effect (0.6) 3.7 3.6 (2.5)

Increase (decrease) in valuation allowance(1) 8.3 — (39.3) 23.2

Goodwill impairment 26.8 — — —

Other, net (0.8) 1.5 0.4 3.3

Effective income tax rate (1.3)% 40.2% (0.3)% (11.0)%

(1) For the four months ended April 30, 2007, the decrease in the valuation allowance reflects fresh start adjustments.

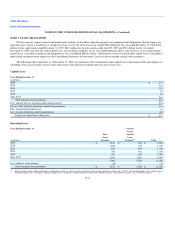

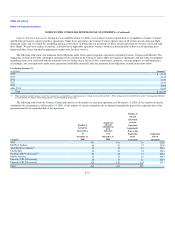

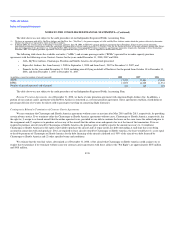

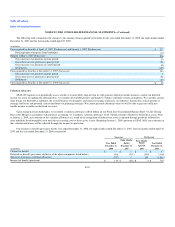

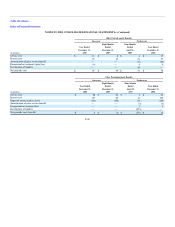

NOTE 10. EMPLOYEE BENEFIT PLANS

We sponsor defined benefit and defined contribution pension plans, postretirement healthcare plans, and disability and survivorship plans for eligible

employees and retirees, and their eligible family members.

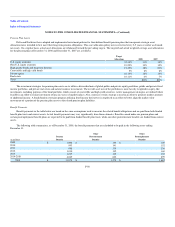

Northwest Merger

In accordance with SFAS 87, "Employers' Accounting for Pensions" ("SFAS 87") and SFAS 106, "Employers' Accounting for Postretirement Benefits

Other Than Pensions" ("SFAS 106"), when an employer is acquired in a merger, any excess of projected benefit obligation over the plan assets is recognized

as a liability and any excess of plan assets over the projected benefit obligation is recognized as a plan asset. The recognition of a new liability or a new asset

by the acquirer, at the date of the merger, results in the elimination of any (1) previously existing unrecognized net gain or loss, (2) unrecognized prior service

cost and (3) unrecognized net transition obligation. In addition, the new liability or asset is measured using actuarial assumptions, as determined by the

purchaser. All significant weighted-average assumptions used were determined based on our policies that are discussed below in "Assumptions."

Defined Benefit Pension, Other Postretirement, and Postemployment Benefit Plans

Defined Benefit Pension Plans. We sponsor a defined benefit pension plan for eligible non-pilot Delta employees and retirees (the "Delta Non-Pilot

Plan") and defined benefit pension plans for eligible Northwest employees and retirees (the "Northwest Pension Plans"). These plans have been closed to new

entrants and frozen for future benefit accruals.

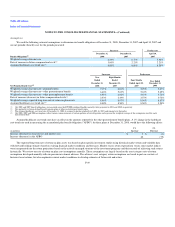

The Pension Protection Act of 2006 allows commercial airlines to elect alternative funding rules ("Alternative Funding Rules") for defined benefit plans

that are frozen. Under the Alternative Funding Rules, the unfunded liability for a frozen defined benefit plan may be amortized over a fixed 17-year period

and is calculated using an 8.85% interest rate. Delta elected the Alternative Funding Rules for the Delta Non-Pilot Plan, effective April 1, 2007 and Northwest

elected the Alternative Funding Rules for the Northwest Pension Plans effective October 1, 2006. We estimate that the funding requirements under these plans

will be approximately $275 million in 2009.

Defined Contribution Pension Plans. Prior to the Merger, both Delta and Northwest sponsored several defined contribution plans and we continue to

sponsor all of those plans. These plans each generally cover different employee groups at Delta and Northwest, and employer contributions vary by each plan.

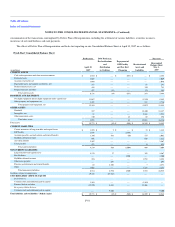

The cost associated with our defined contribution pension plans is reflected in the tables below.

F-44