Delta Airlines 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

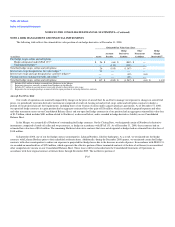

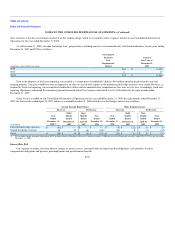

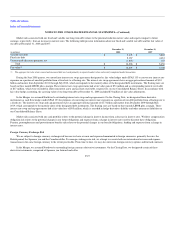

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

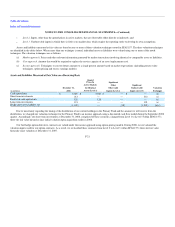

NOTE 2. NORTHWEST MERGER

On the Closing Date, Northwest became a wholly-owned subsidiary of Delta. Northwest is a major air carrier that provides scheduled air transportation

for passengers and cargo throughout the U.S. and around the world.

The Merger better positions us to manage through economic cycles and volatile fuel prices, invest in our fleet, improve services for customers and

achieve our strategic objectives. We believe the Merger will generate significant annual revenue and cost synergies by 2012 from more effective aircraft

utilization, a more comprehensive and diversified route system and cost synergies from reduced overhead and improved operational efficiency.

Pursuant to the Merger Agreement, each share of Northwest common stock outstanding on the Closing Date or issuable under Northwest's Plan of

Reorganization was converted into the right to receive 1.25 shares of Delta common stock. We issued, or expect to issue, a total of 339 million shares of Delta

common stock for these purposes, or approximately 41% of the sum of the shares of Delta common stock (1) outstanding on the Closing Date (including

shares issued to Northwest stockholders in the Merger), (2) issuable in exchange for shares of Northwest common stock reserved for issuance under

Northwest's Plan of Reorganization, (3) reserved for issuance under Delta's Plan of Reorganization and (4) issuable to our employees in connection with the

Merger.

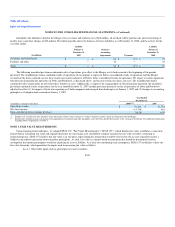

We accounted for the Merger in accordance with SFAS 141, whereby the purchase price paid to effect the Merger was allocated to the tangible and

identifiable intangible assets acquired and liabilities assumed from Northwest based on their estimated fair values as of the Closing Date. For accounting

purposes, the Merger was valued at $3.4 billion. This amount was derived from the 339 million shares of Delta common stock we issued or expect to issue, as

discussed above, at a price of $9.60 per share, the average closing price of our common stock on the New York Stock Exchange for the five consecutive

trading days that include the two trading days before, the day of and the two trading days after the public announcement of the Merger Agreement on

April 14, 2008, and capitalized Merger-related transaction costs. The purchase price also includes the fair value of Delta stock options and other equity awards

issued on the Closing Date in exchange for similar securities of Northwest. Northwest stock options and other equity awards vested on the Closing Date and

were assumed by Delta and modified to provide for the purchase of Delta common stock. Accordingly, the number of shares and, if applicable, the price per

share were adjusted for the 1.25 exchange ratio. Vested stock options held by employees of Northwest are considered part of the purchase price.

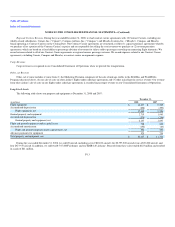

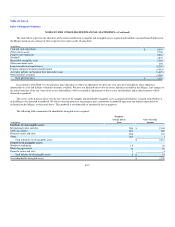

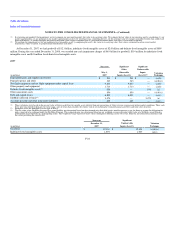

The preliminary purchase price is calculated as follows:

(in millions, except per share data)

Shares of Northwest common stock exchanged 271

Exchange ratio 1.25

Shares of Delta common stock issued or issuable 339

Price per share $ 9.60

Fair value of Delta common stock issued or issuable $3,251

Fair value of outstanding Northwest stock options 18

Delta transaction costs 84

Total purchase price $3,353

F-18