Delta Airlines 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

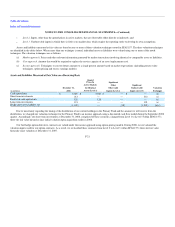

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

basis and, if certain events or circumstances indicate that an impairment loss may have been incurred, on an interim basis. The annual impairment test date for

our goodwill and indefinite-lived intangible assets is October 1.

In evaluating our goodwill for impairment, we first compare our one reporting unit's fair value to its carrying value. We estimate the fair value of our

reporting unit by considering (1) our market capitalization, (2) any premium to our market capitalization an investor would pay for a controlling interest ,

(3) the potential value of synergies and other benefits that could result from such interest, (4) market multiple and recent transaction values of peer companies

and (5) projected discounted future cash flows, if reasonably estimable. If the reporting unit's fair value exceeds its carrying value, no further testing is

required. If, however, the reporting unit's carrying value exceeds its fair value, we then determine the amount of the impairment charge, if any. We recognize

an impairment charge if the carrying value of the reporting unit's goodwill exceeds its implied fair value.

We perform the impairment test for our indefinite-lived intangible assets by comparing the asset's fair value to its carrying value. Fair value is estimated

based on recent market transactions where available or projected discounted future cash flows. We recognize an impairment charge if the asset's carrying

value exceeds its estimated fair value.

Changes in assumptions or circumstances could result in an additional impairment in the period in which the change occurs and in future years. Factors

which could cause impairment include, but are not limited to, (1) negative trends in our market capitalization, (2) volatile fuel prices, (3) declining passenger

mile yields, (4) lower demand as a result of the weakening U.S. and global economy, (5) interruption to our operations due to an employee strike, terrorist

attack, or other reasons and (6) consolidation of competitors within the industry.

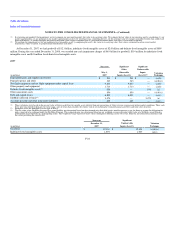

Interest Expense

While operating as a debtor-in-possession under Chapter 11 of the Bankruptcy Code, in accordance with SOP 90-7, we recorded interest expense only

to the extent (1) interest would be paid during our Chapter 11 proceedings or (2) it was probable interest would be an allowed priority, secured or unsecured

claim. Interest expense recorded on our Consolidated Statements of Operations totaled $705 million for the year ended December 31, 2008, $390 million for

the eight months ended December 31 2007, $262 million for the four months ended April 30, 2007 and $870 million for the year ended December 31, 2006.

Contractual interest expense (including interest expense that was associated with obligations classified as liabilities subject to compromise) totaled $366

million for the four months ended April 30, 2007 and $1.2 billion for the year ended December 31, 2006.

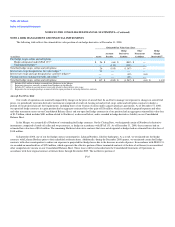

Income Taxes

In accordance with SFAS 109, we account for deferred income taxes under the liability method. Under this method, we recognize deferred tax assets

and liabilities based on the tax effects of temporary differences between the financial statement and tax bases of assets and liabilities, as measured by current

enacted tax rates. A valuation allowance is recorded to reduce deferred tax assets when necessary. Deferred tax assets and liabilities are recorded net as

current and noncurrent deferred income taxes on our Consolidated Balance Sheets.

Our income tax provisions are based on calculations and assumptions that are subject to examination by the Internal Revenue Service (the "IRS") and

other tax authorities. Although we believe that the positions taken on previously filed tax returns are reasonable, we have established tax and interest reserves

in recognition that various taxing authorities may challenge the positions we have taken, which could result in additional liabilities for taxes and interest. We

review the reserves as circumstances warrant and adjust the reserves as events occur

F-15