Delta Airlines 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

other operations for more than two consecutive days (other than as a result of a Federal Aviation Administration ("FAA") suspension due to extraordinary

events similarly affecting other major U.S. air carriers). Upon the occurrence of an event of default, the outstanding obligations under the Exit Facilities may

be accelerated and become due and payable immediately and our cash may become restricted.

Bank Credit Facility

The Bank Credit Facility consisted of a $1.05 billion term loan facility and a $175 million revolving credit facility. On the date of the Merger, the

outstanding term loan facility amount was $773 million and the outstanding revolving credit facility amount was $131 million. The final maturity date of the

Bank Credit Facility, as amended, is the earlier of (1) the date that Northwest Airlines, Inc. is no longer a separate legal entity and an operating airline,

including when it is merged with and into Delta Air Lines, Inc. or (2) December 31, 2010. The Bank Credit Facility is secured by a first lien on Northwest's

Pacific route authorities.

The Bank Credit Facility contains financial covenants that require Northwest to maintain (1) unrestricted cash, cash equivalents and short-term

investments of not less than $750 million, (2) a minimum total collateral coverage ratio (defined as the ratio of (i) the appraised value of the collateral to

(ii) the sum of the aggregate outstanding exposure under the Bank Credit Facility, the aggregate termination value of certain hedging agreements and certain

pari passu obligations) of 150% and (3) a minimum fixed charge coverage ratio, defined as the ratio of EBITDAR to consolidated fixed charges. Fixed

charges are defined as interest expense and aircraft rent expense (without giving effect to any acceleration of rental expense). Additionally, certain aircraft

sublease rental income is excluded from EBITDAR and reduces aircraft rental expense in fixed charges. Compliance by Northwest with this financial

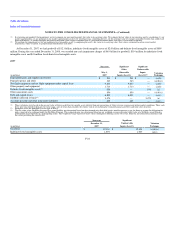

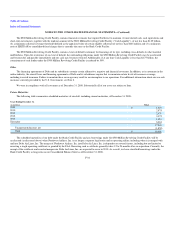

covenant has been waived through March 31, 2009 followed by a phase-in period as set forth below:

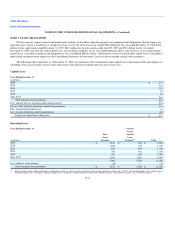

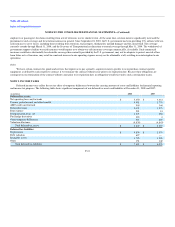

Number of Months

Covered Period Ending

Required Coverage

Ratio

Three June 30, 2009 1.00 to 1.00

Six September 30, 2009 1.10 to 1.00

Nine December 31, 2009 1.20 to 1.00

Twelve March 31, 2010 1.30 to 1.00

Twelve June 30, 2010 1.40 to 1.00

Twelve September 30, 2010 1.50 to 1.00

The Bank Credit Facility contains events of default that are customary for financings of its type, including cross-defaults to other material indebtedness

and maintenance of pledged slots and routes. Upon the occurrence of an event of default, the outstanding obligations under the Bank Credit Facility may be

accelerated and become due and payable immediately.

$500 Million Revolving Credit Facility

The $500 Million Revolving Credit Facility matures at the earlier of (1) October 2009 (with respect to $300 million of such facility) or October 2011

(with respect to $200 million of such facility) or (2) the date that Northwest Airlines, Inc. is no longer a separate legal entity and an operating airline,

including when it is merged with and into Delta Air Lines, Inc. Borrowings under the $500 Million Revolving Credit Facility can be prepaid without penalty

and amounts prepaid can be reborrowed. Borrowings under the $500 Million Revolving Credit Facility are guaranteed by Northwest Airlines Corporation and

certain of its subsidiaries. The $500 Million Revolving Credit Facility and related guarantees are secured by substantially all of Northwest's unencumbered

assets as of October 29, 2008.

F-33