Delta Airlines 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

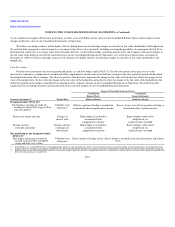

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

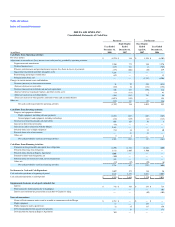

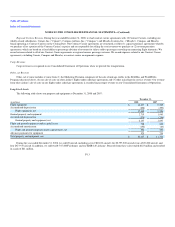

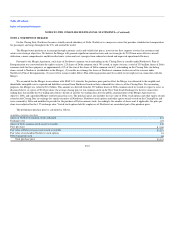

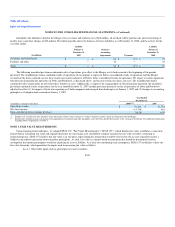

Fair value hedges

For derivative instruments that are designated and qualify as a fair value hedge under SFAS 133, the gain or loss on the derivative and the offsetting

loss or gain on the hedged item attributable to the hedged risk are recognized in current earnings. We include the gain or loss on the hedged item in the same

account as the offsetting loss or gain on the related derivative instrument, resulting in no impact to our Consolidated Statements of Operations. The following

table summarizes the accounting treatment and classification of our fair value hedges on our Consolidated Financial Statements:

Impact of Unrealized Gains and Losses

Consolidated

Balance Sheets

Consolidated

Income Statements

Derivative Instrument Hedged Risk Effective Portion Ineffective Portion

Designated under SFAS

133:

Interest rate swaps

Changes in

interest rates

Entire fair value of hedge is recorded in long-term

debt and capital leases

Expect hedge to be perfectly effective at offsetting changes in

fair value of the related debt; no ineffectiveness recorded

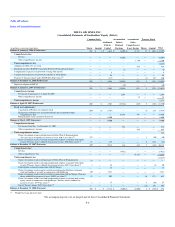

Hedge Margin

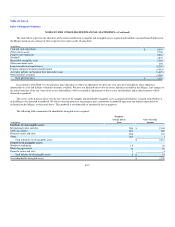

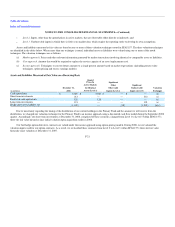

In accordance with our hedge agreements, (1) we may require counterparties to fund the margin associated with our gain position on hedge contracts

and (2) counterparties may require us to fund the margin associated with our loss position on these contracts. The amount of the margin, if any, is periodically

adjusted based on the fair value of the hedge contracts. The margin requirements are intended to mitigate a party's exposure to market volatility and the

associated contracting party risk. We do not offset margin funded to counterparties or margin funded to us by counterparties against fair value amounts

recorded for our hedge contracts.

The hedge margin we receive from counterparties is recorded, as appropriate, in cash and cash equivalents or restricted cash, with the offsetting

obligation in other accrued liabilities on our Consolidated Balance Sheets. The margin we provide to counterparties is recorded in hedge margin receivable or

restricted cash on our Consolidated Balance Sheets. All cash flows associated with purchasing and settling fuel hedge contracts are classified as operating

cash flows on our Consolidated Statements of Cash Flows.

In accordance with our interest rate swap and cap agreements, which we assumed from Northwest in the Merger and which qualify as cash flow hedges,

the respective counterparties are not required to fund margin to us and we are not required to fund margin to them.

Revenue Recognition

Passenger Revenue

Passenger Tickets. We record sales of passenger tickets in air traffic liability on our Consolidated Balance Sheets. Passenger revenue is recognized

when we provide transportation or when the ticket expires unused, reducing the related air traffic liability. We periodically evaluate the estimated air traffic

liability and record any resulting adjustments in our Consolidated Statements of Operations in the period in which the evaluations are completed. These

adjustments relate primarily to refunds, exchanges, transactions with other airlines and other items for which final settlement occurs in periods subsequent to

the sale of the related tickets at amounts other than the original sales price.

F-11