Delta Airlines 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

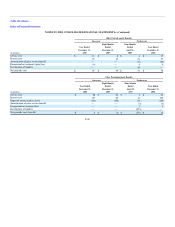

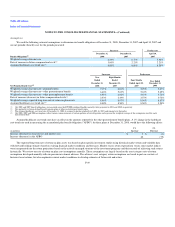

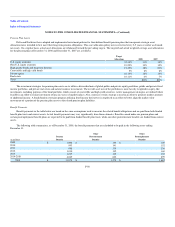

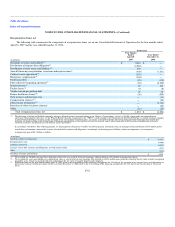

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

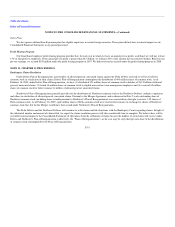

Treasury Stock. We generally withhold shares of Delta common stock to cover employees' portion of required tax withholdings when employee equity

awards are issued or vest. These shares are valued at cost, which equals the market price of the common stock on the date of issuance or vesting. In December

2008, we sold from treasury approximately 18 million shares of our common stock that were previously withheld as the employee portion of tax withholdings

on the issuance and vesting of employee equity awards in connection with the Merger. The $192 million of net proceeds from the offering will be used for

general corporate purposes. At December 31, 2008, there were approximately eight million shares of common stock held in treasury at a weighted average

cost of $20.11 per share. Substantially all of these shares were withheld to cover the employees' portion of required tax withholdings on equity awards.

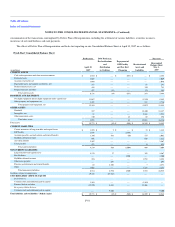

Equity-Based Compensation

Successor

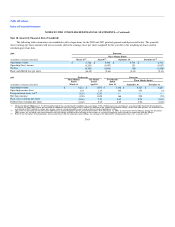

Upon emergence from Chapter 11, we adopted with Bankruptcy Court approval the 2007 Plan, a broad based equity and cash compensation plan. The

2007 Plan provides for grants of restricted stock, stock options, stock appreciation rights, restricted stock units, performance awards, including cash incentive

awards, and other stock based awards. Shares of common stock issued under the 2007 Plan may be made available from authorized but unissued common

stock or common stock we acquire. If any shares of our common stock are covered by an award that is cancelled, forfeited or otherwise terminates without

delivery of shares (including shares surrendered or withheld for payment of the exercise price of an award or taxes related to an award), then such shares will

again be available for issuance under the 2007 Plan. In connection with the Merger, we amended the 2007 Plan with stockholder approval to increase the

number of shares of Delta common stock issuable under the plan from 30 million to 157 million. The purpose of this amendment was to permit Delta to grant

equity to substantially all employees of the combined company in connection with the Merger. As of December 31, 2008, 36 million shares remain available

for future grants under the 2007 Plan.

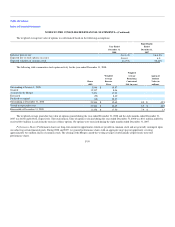

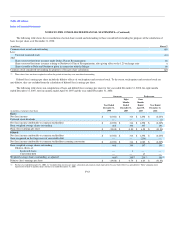

Under SFAS 123R, non-cash compensation expense for equity awards is recognized over the employee's requisite service period (generally, the vesting

period of the award). We use straight-line recognition for awards with installment vesting, as allowed under SFAS 123R. During the year ended December 31,

2008 and the eight months ended December 31, 2007, we recognized expense associated with restricted stock, stock option, and performance share grants of

$66 million and $109 million in salaries and related costs, respectively. Additionally, the closing of the Merger constituted a change in control under the 2007

Plan, which caused the vesting of substantially all previously unvested equity awards and resulted in the recording of $75 million in expense to restructuring

and merger-related items. These expenses do not represent cash payments actually made to employees; rather it represents non-cash compensation expense for

financial reporting purposes. The actual value of these awards to the recipients depends on the price of Delta common stock when the awards vest.

As of December 31, 2008, approximately $187 million of total unrecognized costs related to unvested shares and options are expected to be recognized

over the remaining weighted-average period of 1.3 years. Approximately $83 million is expected to be recognized in 2009.

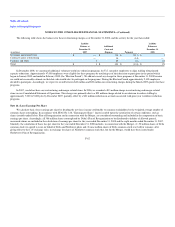

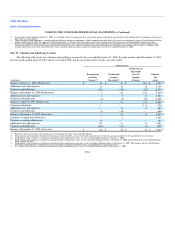

Stock Grants. In connection with the Merger, we granted equity to substantially all employees of Delta and Northwest. U.S. based non-pilot, non-

management employees received 34 million shares of common stock. Pilot employees were granted the right to receive 50 million shares of common stock.

The fair value of these grants was based on the closing price of the common stock on the date of grant and resulted in the recording of a $791 million charge

in restructuring and merger-related items. In 2007, upon emergence from Chapter 11, we issued 14 million shares of common stock to non-contract, non-

management employees. Employees may hold or sell these shares without restriction.

Merger Awards. In connection with the Merger, we made grants of restricted stock and stock options to approximately 700 management level

employees under the 2007 Plan. As discussed below, these grants vest over three years, subject to the employee's continued employment.

F-57