Delta Airlines 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

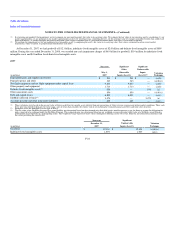

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

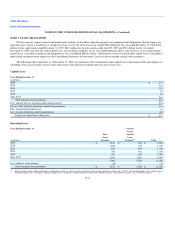

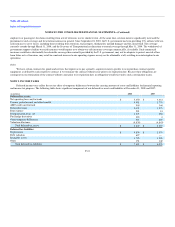

(9) This item includes a reduction in the carrying value of (1) Northwest's debt as a result of purchase accounting related to the Merger and (2) the debt recorded in connection with the

American Express Agreement. This item also includes fair value adjustments to our long-term debt in connection with our adoption of fresh start reporting upon our emergence from

bankruptcy. These adjustments will be amortized to interest expense over the remaining maturities of the respective debt.

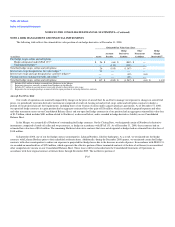

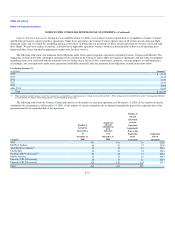

Delta Exit Financing

The Exit Facilities consist of a $1.0 billion first-lien revolving credit facility (the "Revolving Facility"), a $600 million first-lien synthetic revolving

facility (the "Synthetic Facility") (together with the Revolving Facility, the "First-Lien Facilities"), and a $900 million second-lien term loan facility (the

"Term Loan" or the "Second-Lien Facility"). During 2008, we borrowed the entire amount of the Revolving Facility. Borrowings under the First-Lien

Facilities are due in April 2012 and borrowings under the Second-Lien Facility are due in April 2014.

Our obligations under the Exit Facilities are guaranteed by substantially all of our domestic subsidiaries, including, after the closing of the Merger,

Northwest Airlines Corporation and certain of its subsidiaries (the "Guarantors"). The Exit Facilities and the related guarantees are secured by liens on

substantially all of our and the Guarantors' present and future assets (excluding, in the case of Northwest Guarantors, assets subject to existing liens at the time

of closing of the Merger) (the "Collateral"). The First-Lien Facilities are secured by a first priority security interest in the Collateral. The Second-Lien Facility

is secured by a second priority security interest in the Collateral.

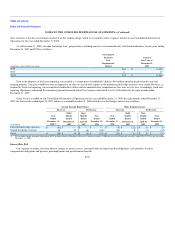

The Exit Facilities include affirmative, negative and financial covenants that restrict our ability to, among other things, incur additional secured

indebtedness, make investments, sell or otherwise dispose of assets if not in compliance with the collateral coverage ratio tests, pay dividends or repurchase

stock. These covenants may have a material adverse impact on our operations. The Exit Facilities contain financial covenants that require us to:

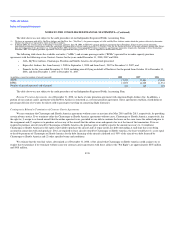

• maintain a minimum fixed charge coverage ratio (defined as the ratio of (1) earnings before interest, taxes, depreciation, amortization and aircraft

rent, and subject to other adjustments to net income ("EBITDAR") to (2) the sum of gross cash interest expense, cash aircraft rent expense and

the interest portion of our capitalized lease obligations, for successive trailing 12-month periods ending at each quarter-end date through the

maturity date of the respective Exit Facilities), which minimum ratio will range from 1.00:1 to 1.20:1 in the case of the First-Lien Facilities and

from 0.85:1 to 1.02:1 in the case of the Second-Lien Facility;

• maintain unrestricted cash, cash equivalents and permitted investments of not less than $750 million in the case of the First-Lien Facilities and

$650 million in the case of the Second-Lien Facility;

• maintain a minimum total collateral coverage ratio (defined as the ratio of (1) certain of the Collateral that meets specified eligibility standards

("Eligible Collateral") to (2) the sum of the aggregate outstanding exposure under the First-Lien Facilities and the Second-Lien Facility and the

aggregate termination value of certain hedging agreements) of 125% at all times; and

• in the case of the First-Lien Facilities, also maintain a minimum first-lien collateral coverage ratio (together with the total collateral coverage

ratio described above, the "collateral coverage ratios") (defined as the ratio of (1) Eligible Collateral to (2) the sum of the aggregate outstanding

exposure under the First Lien Facilities and the aggregate termination value of certain hedging agreements) of 175% at all times.

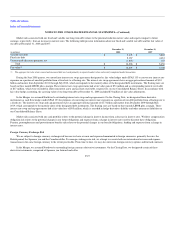

The Exit Facilities contain events of default customary for senior secured exit financings, including cross-defaults to other material indebtedness and

certain change of control events. The Exit Facilities also include events of default specific to our business, including the suspension of all or substantially all

of our flights and

F-32