Delta Airlines 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

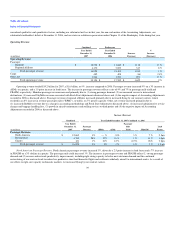

In connection with the closing of the Merger, we awarded to substantially all U.S. based Delta and Northwest employees an aggregate of 101 million

shares of common stock. This award recognizes the critical role of our employees in assisting us achieve our financial, operational and customer service goals.

As a result of this award, we recorded $791 million in one-time primarily non-cash charges to restructuring and Merger-related items.

We expect to incur one-time cash costs of approximately $500 million over approximately three years to integrate the two airlines. We plan to integrate

the operations of Northwest into Delta as promptly as is feasible, which we anticipate we will substantially complete in 2010.

Outlook

We believe a combination of lower fuel prices, capacity reductions, and merger synergies better positions us to effectively manage our business through

the current economic crisis. Nevertheless, we expect to report a significant loss in the March 2009 quarter primarily due to fuel hedge losses coupled with the

impact of the global recession, which has weakened demand for air travel, and the first quarter traditionally being our weakest quarter due to seasonality.

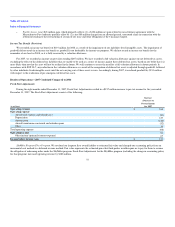

Fuel Prices and Other Costs

In 2009, we expect to use approximately four billion gallons of jet fuel. At that level of consumption, a $1 change in the average annual per barrel price

of crude oil can impact our financial results by approximately $100 million. Accordingly, the volatility of fuel prices will continue to have a major impact on

our financial results.

As discussed above, at current market prices we will recognize losses on hedge contracts that we entered into in 2008 when fuel prices were much

higher. The majority of these losses will be recognized in the first half of 2009, as the hedged fuel is purchased and consumed. In January 2009, we have

added new hedges that reflect current market prices, approximating 16% of our estimated 2009 consumption. Should fuel prices remain at their current levels,

we will realize significant savings in fuel costs compared to 2008.

We expect higher pension expense in 2009 compared to 2008 from a decline in the value of our defined benefit plan assets driven by market conditions

and increases in certain other operating expenses in 2009 compared to 2008 due to timing delays between the reduction in capacity and our ability to remove

certain capacity-related costs. We also expect to record approximately $260 million of higher interest expense related to increased amortization of debt

discount, reflecting lower fair value of Northwest debt as of the Closing Date.

Demand and Capacity

The global economic recession has resulted in weaker demand for air travel. Our demand began to slow during the December 2008 quarter and we

believe worsening global economic conditions in 2009 will substantially reduce U.S. airline industry revenues in 2009 compared to 2008. As a result, we have

announced plans to further reduce capacity by 6-8% in 2009 compared to 2008 (which reflect planned reductions in domestic capacity of 8-10% and

international capacity of 3-5%). If economic conditions continue to worsen, we expect to make additional reductions to our capacity. We believe we have

flexibility in our network and fleet to remove additional capacity if the environment warrants.

In December 2008, we announced additional voluntary workforce reduction programs for U.S. based non-pilot employees to align staffing with the

planned capacity reductions. Approximately 2,100 employees elected to participate. We expect to record between $40 million and $50 million in restructuring

charges during the March 2009 quarter for these programs.

31