Delta Airlines 2008 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

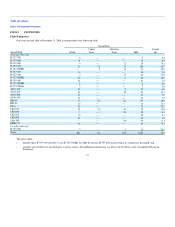

Table of Contents

Index to Financial Statements

approximately 80% of the NWA employees are represented by labor unions while, among U.S. based employees, only the pre-merger Delta pilots and flight

dispatchers (who combined constitute approximately 17% of the total pre-merger Delta employees) are currently represented by labor unions. The integration

of the workforces of the two airlines will require the resolution of potentially difficult issues relating to representation of various work groups and the relative

seniority of the work groups at each carrier. Unexpected delay, expense or other challenges to integrating the workforces could impact the expected synergies

from the combination of Delta and Northwest and affect the financial performance of the combined company.

Interruptions or disruptions in service at one of our hub airports could have a material adverse impact on our operations.

Our business is heavily dependent on our operations at the Atlanta Airport and at our other hub airports in Cincinnati, Detroit, Memphis, Minneapolis/

St. Paul, New York-JFK, Salt Lake City, Amsterdam and Tokyo-Narita. Each of these hub operations includes flights that gather and distribute traffic from

markets in the geographic region surrounding the hub to other major cities and to other Delta hubs. A significant interruption or disruption in service at the

Atlanta airport or at one of our other hubs could have a serious impact on our business, financial condition and results of operations.

We are increasingly dependent on technology in our operations, and if our technology fails or we are unable to continue to invest in new technology,

our business may be adversely affected.

We have become increasingly dependent on technology initiatives to reduce costs and to enhance customer service in order to compete in the current

business environment. For example, we have made significant investments in delta.com, check-in kiosks and related initiatives. The performance and

reliability of the technology are critical to our ability to attract and retain customers and our ability to compete effectively. These initiatives will continue to

require significant capital investments in our technology infrastructure to deliver these expected benefits. If we are unable to make these investments, our

business and operations could be negatively affected. In addition, we may face challenges associated with integrating complex systems and technologies that

support the separate operations of Delta and NWA. If we are unable to manage these challenges effectively, our business and results of operation could be

negatively affected.

In addition, any internal technology error or failure or large scale external interruption in technology infrastructure we depend on, such as power,

telecommunications or the internet, may disrupt our technology network. Any individual, sustained or repeated failure of technology could impact our

customer service and result in increased costs. Like all companies, our technology systems and related data may be vulnerable to a variety of sources of

interruption due to events beyond our control, including natural disasters, terrorist attacks, telecommunications failures, computer viruses, hackers and other

security issues. While we have in place, and continue to invest in, technology security initiatives and disaster recovery plans, these measures may not be

adequate or implemented properly to prevent a business disruption and its adverse financial consequences to our business.

If we experience losses of senior management personnel and other key employees, our operating results could be adversely affected.

We are dependent on the experience and industry knowledge of our officers and other key employees to execute our business plans. If we experience a

substantial turnover in our leadership and other key employees, our performance could be materially adversely impacted. Furthermore, we may be unable to

attract and retain additional qualified executives as needed in the future.

Our credit card processors have the ability to take significant holdbacks in certain circumstances. The initiation of such holdbacks likely would have a

material adverse effect on our liquidity.

We sell a substantial number of tickets that are paid for by customers who use credit cards. Our credit card processing agreements provide that no future

holdback of receivables or reserve is required except in certain

17