Delta Airlines 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

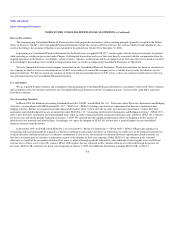

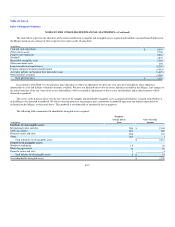

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Cash and Cash Equivalents

We classify short-term, highly liquid investments with maturities of three months or less when purchased as cash and cash equivalents. These

investments are recorded at cost, which approximates fair value.

Short-Term Investments

At December 31, 2008, our short-term investments were comprised of an investment in The Reserve Primary Fund (the "Primary Fund"), a money

market fund that is undergoing an orderly liquidation. In accordance with SFAS No. 115, "Accounting for Certain Investments in Debt and Equity Securities,"

we record these investments as available-for-sale securities at fair value on our Consolidated Balance Sheet.

At December 31, 2008, the fair value of our investment in the Primary Fund was $212 million. The cost of this investment was $225 million. In mid-

September 2008, the net asset value of the Primary Fund decreased below $1 per share as a result of the Primary Fund's valuing at zero its holdings of debt

securities issued by Lehman Brothers Holdings, Inc. ("Lehman Brothers"), which filed for bankruptcy on September 15, 2008. Accordingly, we recorded an

other than temporary impairment of $13 million as an unrealized loss to the cost basis of our pro rata share of the estimated loss in this investment.

We have requested the redemption of our investment in the Primary Fund. We expect distributions will occur as the Primary Fund's assets mature or are

sold. While we expect to receive substantially all of our current holdings in the Primary Fund, we cannot predict when this will occur or the amount we will

receive. Accordingly, we have reclassified our investment from cash and cash equivalents to short-term investments on our Consolidated Balance Sheet as of

December 31, 2008.

At December 31, 2007, our short-term investments were comprised of insured auction rate securities. For additional information regarding our

accounting for auction rate securities, see "Investments in Debt and Equity Securities" in this Note.

Restricted Cash and Cash Equivalents

Restricted cash and cash equivalents included in current assets on our Consolidated Balance Sheets totaled $429 million and $520 million at

December 31, 2008 and 2007, respectively. Restricted cash recorded in other noncurrent assets on our Consolidated Balance Sheets totaled $24 million and

$15 million at December 31, 2008 and 2007, respectively. Restricted cash and cash equivalents are recorded at cost, which approximates fair value.

At December 31, 2008, our restricted cash and cash equivalents primarily related to cash held to meet certain projected self-insurance obligations and

employee benefits.

At December 31, 2007, our restricted cash primarily related to (1) $295 million held in a grantor trust for the benefit of Delta pilots to fund the then

remaining balance of an obligation we had under our comprehensive agreement with the Air Line Pilots Association, International ("ALPA"), the collective

bargaining representative of Delta pilots, to reduce pilot labor costs and (2) cash held to meet certain projected self-insurance obligations. The amount in the

grantor trust was classified as restricted cash with a corresponding note payable on our Consolidated Balance Sheet until the amount was distributed in

January 2008.

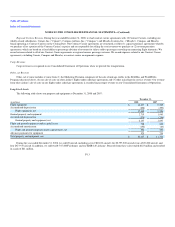

Derivative Financial Instruments

Our results of operations are materially impacted by changes in aircraft fuel prices, interest rates and foreign currency exchange rates. In an effort to

manage our exposure to these risks, we periodically enter into various derivative instruments, including fuel, interest rate and foreign currency hedges. In

accordance with SFAS 133,

F-9