Delta Airlines 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

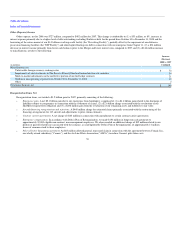

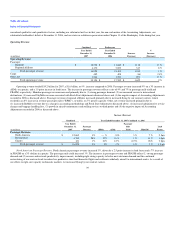

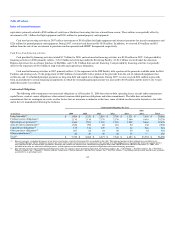

Other (Expense) Income

Other expense, net for 2008 was $727 million, compared to $492 million for 2007. This change is attributable to (1) a $53 million, or 8%, increase in

interest expense primarily due to a higher level of debt outstanding, including Northwest debt for the period from October 30 to December 31, 2008 and the

borrowing of the entire amount of our $1.0 billion revolving credit facility (the "Revolving Facility"), partially offset by the repayment of our debtor-in-

possession financing facilities (the "DIP Facility") and other higher floating rate debt in connection with our emergence from Chapter 11, (2) a $36 million

decrease in interest income primarily from lower cash balances prior to the Merger and lower interest rates compared to 2007 and (3) a $146 million increase

to miscellaneous, net due to the following:

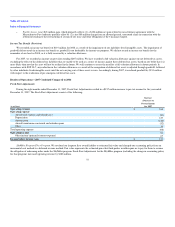

(in millions)

Increase

(Decrease)

2008 vs. 2007

Combined

Miscellaneous, net

Unfavorable foreign currency exchange rates $ 72

Impairments of our investments in The Reserve Primary Fund and insured auction rate securities 34

Mark-to-market adjustments on the ineffective portion of our fuel hedge contracts 21

Northwest non-operating expense from October 30 to December 31, 2008 12

Other 7

Total miscellaneous, net $ 146

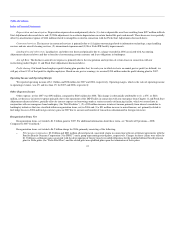

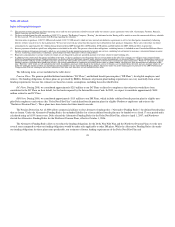

Reorganization Items, Net

Reorganization items, net totaled a $1.2 billion gain for 2007, primarily consisting of the following:

• Emergence gain. A net $2.1 billion gain due to our emergence from bankruptcy, comprised of (1) a $4.4 billion gain related to the discharge of

liabilities subject to compromise in connection with the settlement of claims, (2) a $2.6 billion charge associated with the revaluation of our

SkyMiles frequent flyer obligation and (3) a $238 million gain from the revaluation of our remaining assets and liabilities to fair value.

• Aircraft financing renegotiations and rejections. A $440 million charge for estimated claims primarily associated with the restructuring of the

financing arrangements for 143 aircraft and adjustments to prior claims estimates.

• Contract carrier agreements. A net charge of $163 million in connection with amendments to certain contract carrier agreements.

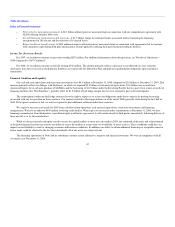

• Emergence compensation. In accordance with Delta's Plan of Reorganization, we made $130 million in lump-sum cash payments to

approximately 39,000 eligible non-contract, non-management employees. We also recorded an additional charge of $32 million related to our

portion of payroll related taxes associated with the issuance, as contemplated by Delta's Plan of Reorganization, of approximately 14 million

shares of common stock to those employees.

• Pilot collective bargaining agreement. An $83 million allowed general, unsecured claim in connection with the agreement between Comair, Inc.,

our wholly owned subsidiary ("Comair"), and the Air Line Pilots Association ("ALPA") to reduce Comair's pilot labor costs.

36