Delta Airlines 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

that affect our potential liability, such as lapsing of applicable statutes of limitations, conclusion of tax audits, a change in exposure based on current

calculations, identification of new issues, release of administrative guidance or the rendering of a court decision affecting a particular issue. We would adjust

the income tax provision in the period in which the facts that give rise to the revision become known.

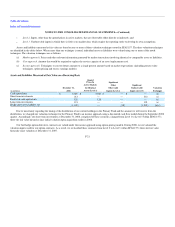

Investments in Debt and Equity Securities

We record our investments in student loan backed auction rate securities acquired in the Merger as available-for-sale securities at fair value. Any

change in the fair value of these securities is recorded in accumulated other comprehensive (loss) income. At December 31, 2008, the fair value of our student

loan backed auction rate securities was $38 million. The cost of these investments was $45 million.

We record our investments in insured auction rate securities as trading securities at fair value. Any change in the fair value of these securities is

recorded in other (expense) income on our Consolidated Statements of Operations. At December 31, 2008 and 2007, the fair value of our insured auction rate

securities was $83 million and $107 million, respectively. The cost of these investments was $110 million.

Due to the protracted failure in the auction process and contractual maturities averaging 27 years for our insured auction rate securities and 32 years for

our student loan backed auction rate securities, we have reclassified our auction rate securities to long-term within other noncurrent assets on our Consolidated

Balance Sheet at December 31, 2008.

Because auction rate securities are not actively traded, fair values were estimated by discounting the cash flows expected to be received over the

remaining maturities of the underlying securities. The valuations are based on our assessment of observable yields on instruments bearing comparable risks

and consider the creditworthiness of the underlying debt issuer. Changes in market conditions could result in further adjustments to the fair value of these

securities.

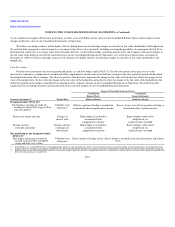

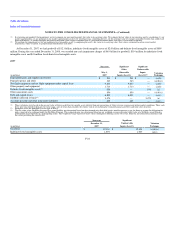

Deferred Gains on Sale and Leaseback Transactions

We amortize deferred gains on the sale and leaseback of property and equipment under operating leases over the lives of these leases. The amortization

of these gains is recorded as a reduction to rent expense. Gains on the sale and leaseback of property and equipment under capital leases reduce the carrying

value of the related assets.

Manufacturers' Credits

We periodically receive credits in connection with the acquisition of aircraft and engines. These credits are deferred until the aircraft and engines are

delivered, and then applied on a pro rata basis as a reduction to the cost of the related equipment.

Maintenance Costs

We record maintenance costs in aircraft maintenance materials and outside repairs on our Consolidated Statements of Operations as they are incurred.

Modifications that enhance the operating performance or extend the useful lives of airframes or engines are capitalized and amortized over the remaining

estimated useful life of the asset or the remaining lease term, whichever is shorter.

F-16