Delta Airlines 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General Information

On October 29, 2008 (the "Closing Date"), we completed our merger (the "Merger") with Northwest, creating the world's largest airline. We now offer

service to 378 worldwide destinations in 66 countries and expect to serve more than 170 million passengers each year. Combined with the reach of SkyTeam,

our global airline alliance, and our codeshare partners, our customers can fly to 570 destinations in 111 countries. The Merger better positions us to manage

through economic cycles and volatile oil prices, invest in our fleet, improve services for customers and achieve our strategic objectives.

Year in Review

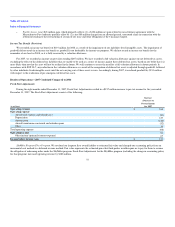

For 2008, we reported a consolidated net loss of $8.9 billion, which reflects (1) a $7.3 billion non-cash charge from an impairment of goodwill and

other intangible assets, (2) $1.1 billion in primarily non-cash Merger-related charges, (3) significantly increased fuel costs and (4) weakened demand due to

the onset of a global recession.

During 2008, fuel prices fluctuated dramatically. Fuel is one of our most significant costs. At the beginning of the year, crude oil prices hovered around

$100 per barrel, escalating to $145 per barrel by mid-summer. We were not able to increase revenues through ticket prices, fuel surcharges or other passenger

service fees to cover all of our higher fuel costs. Accordingly, we reduced capacity by 5% in the second half of the year compared to our 2008 plan. As part of

this capacity reduction, we removed 31 aircraft from our operating fleet, of which 22 have been sold or returned to the lessors and nine remain temporarily

grounded or held for sale. We also offered voluntary workforce reduction programs to our U.S. based non-pilot employees during the year. These programs

helped us right-size our workforce to the capacity reductions. Approximately 4,200 employees, or 8% of our pre-Merger workforce, elected to participate in

these programs.

Throughout the summer months, fuel prices remained at record high levels and were forecasted to continue to rise. Based on this outlook, we added fuel

hedges to protect against further escalating fuel costs. However, fuel prices fell dramatically during the third and fourth quarters, creating sizable losses on our

fuel hedge contracts in the fourth quarter. Losses on our derivative contracts that relate to jet fuel purchases in 2009 are deferred on our Consolidated Balance

Sheet for 2008 and will be recognized in 2009 when the hedged jet fuel is purchased and consumed.

Northwest Merger

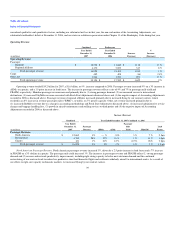

We believe the Merger will generate approximately $2 billion in annual revenue and cost synergies by 2012 from more effective aircraft utilization, a

more comprehensive and diversified route system and cost synergies from reduced overhead and improved operational efficiency. We expect to realize the

following benefits from integrating the operations of Delta and Northwest:

• As a globally-balanced airline, we are better positioned to compete in the Open Skies environment by combining Delta's strengths in the south,

mountain west and northeast United States, Europe and Latin America with Northwest's presence in the midwest and northwest United States and

Asia;

• We expect the combined company to have the financial strength and flexibility to weather cyclical conditions in the airline industry; and

• Delta's and Northwest's complementary networks and common membership in the SkyTeam alliance are expected to ease the combination of

operations that have complicated past mergers within the airline industry.

30