Delta Airlines 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

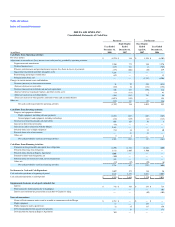

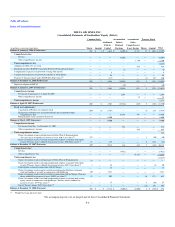

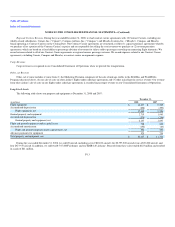

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Basis of Presentation

The accompanying Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United

States of America ("GAAP"). Our Consolidated Financial Statements include the accounts of Delta Air Lines, Inc. and our wholly-owned subsidiaries. As a

result of the Merger, the accounts of Northwest are included for the period from October 30 to December 31, 2008.

In preparing our Consolidated Financial Statements for the Predecessor, we applied SOP 90-7, which requires that the financial statements for periods

while operating as a debtor-in-possession under Chapter 11 distinguish transactions and events that were directly associated with the reorganization from the

ongoing operations of the business. Accordingly, certain revenues, expenses, realized gains and losses and provisions for losses that were realized or incurred

in the bankruptcy proceedings were recorded in reorganization items, net on the accompanying Consolidated Statements of Operations.

We have eliminated all material intercompany transactions in our Consolidated Financial Statements. We do not consolidate the financial statements of

any company in which we have an ownership interest of 50% or less unless we control that company or it is a variable interest entity for which we are the

primary beneficiary. We did not control any company in which we had an ownership interest of 50% or less, or have any material variable interest entity for

any period presented in our Consolidated Financial Statements.

Use of Estimates

We are required to make estimates and assumptions when preparing our Consolidated Financial Statements in accordance with GAAP. These estimates

and assumptions affect the amounts reported in our Consolidated Financial Statements and the accompanying notes. Actual results could differ materially

from those estimates.

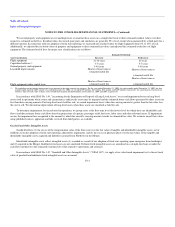

New Accounting Standards

In March 2008, the Financial Accounting Standards Board (the "FASB") issued SFAS No. 161, "Disclosures about Derivative Instruments and Hedging

Activities—an amendment to FASB Statement No. 133" ("SFAS 161"). SFAS 161 changes the disclosure requirements for derivative instruments and

hedging activities. Entities are required to provide enhanced disclosures about (1) how and why an entity uses derivative instruments, (2) how derivative

instruments and related hedged items are accounted for under SFAS No. 133, "Accounting for Derivative Instruments and Hedging Activities" ("SFAS 133"),

and (3) how derivative instruments and related hedged items affect an entity's financial position, financial performance and cash flows. SFAS 161 is effective

for fiscal years and interim periods beginning on January 1, 2009. We currently provide significant information about our hedging activities and use of

derivatives in our quarterly and annual filings. Accordingly, we expect the adoption of SFAS 161 will not have a material impact on our consolidated

financial statements and disclosures.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), "Business Combinations" ("SFAS 141R"). SFAS 141R provides guidance for

recognizing and measuring goodwill acquired in a business combination and requires disclosure of information to enable users of the financial statements to

evaluate the nature and financial effects of a business combination. It also revises the treatment of valuation allowance adjustments related to income tax

benefits in existence prior to a business combination or prior to the adoption of fresh start reporting. Under SFAS 141, any reduction in the valuation

allowance as a result of the recognition of deferred tax assets is adjusted through goodwill, followed by other indefinite-lived intangible assets until the net

carrying costs of these assets is zero. By contrast, SFAS 141R requires that any reduction in this valuation allowance be reflected through the income tax

provision. SFAS 141R is effective for fiscal years beginning on January 1, 2009. For additional information regarding SFAS 141R, see Note 9.

F-8