Delta Airlines 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

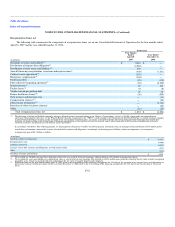

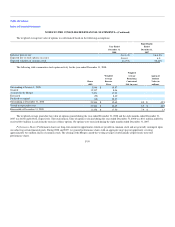

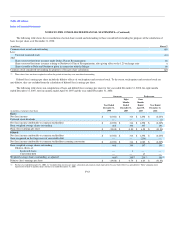

The following table shows the balances for these restructuring charges as of December 31, 2008, and the activity for the year then ended:

(in millions)

Liability

Balance at

December 31,

2007

Additional

Costs and

Expenses Payments

Liability

Balance at

December 31,

2008

Severance and related costs $ — $ 114 $ (111) $ 3

Contract Carrier restructuring — 14 (14) —

Facilities and other 3 25 (6) 22

Total $ 3 $ 153 $ (131) $ 25

In December 2008, we announced additional voluntary workforce reduction programs for U.S. non-pilot employees to align staffing with planned

capacity reductions. Approximately 47,000 employees were eligible for these programs by notifying us of their decision to participate in the period which

began in January 2009 and ended in February 2009 (the "Election Period"). We did not record any charge for these programs at December 31, 2008 because

we could not reasonably estimate on that date who would elect to participate in the programs. During the Election Period, approximately 2,100 employees

decided to participate. Accordingly, we expect to record between $40 million and $50 million in restructuring charges during the March 2009 quarter for these

programs.

In 2007, we did not have any restructuring and merger-related items. In 2006, we recorded a $13 million charge in restructuring and merger-related

items on our Consolidated Statement of Operations. This charge was primarily due to a $29 million charge related to our decision to reduce staffing by

approximately 7,000 to 9,000 jobs by December 2007, partially offset by a $21 million reduction in accruals associated with prior year workforce reduction

programs.

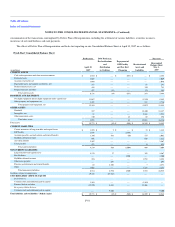

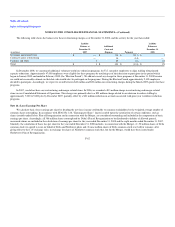

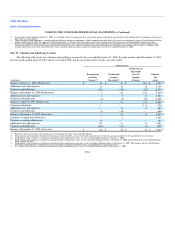

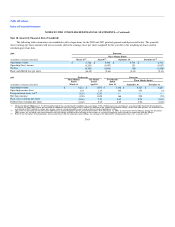

Note 16. (Loss) Earnings Per Share

We calculate basic (loss) earnings per share by dividing the net (loss) income attributable to common stockholders by the weighted average number of

common shares outstanding. In accordance with SFAS No. 128, "Earnings per Share," shares issuable upon the satisfaction of certain conditions, such as

shares issuable under Delta's Plan of Reorganization and in connection with the Merger, are considered outstanding and included in the computation of basic

earnings per share. Accordingly, all 386 million shares contemplated by Delta's Plan of Reorganization to be distributed to holders of allowed general,

unsecured claims are included in the calculation of earnings per share for the year ended December 31, 2008 and the eight months ended December 31, 2007.

Similarly, the calculation of basic loss per share for the year ended December 31, 2008 includes, in connection with the Merger, (1) 50 million shares of Delta

common stock we agreed to issue on behalf of Delta and Northwest pilots and (2) nine million shares of Delta common stock reserved for issuance, after

giving effect to the 1.25 exchange ratio, in exchange for shares of Northwest common stock that, but for the Merger, would have been issued under

Northwest's Plan of Reorganization.

F-62