Delta Airlines 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

Significant Liquidity Events

Significant liquidity events during 2008 were as follows:

• American Express Agreement. In December 2008, we entered into a multi-year extension of our exclusive Co-brand Credit Card relationship with

American Express (the "American Express Agreement"). As part of the American Express Agreement, we received $1.0 billion from American

Express for an advance purchase of SkyMiles. We also expect to receive an additional $1.0 billion benefit from contract improvements through

2010.

• Exit financing facility. In August 2008, we borrowed the entire amount of our $1.0 billion Revolving Facility under the Exit Facilities to increase

our financial flexibility.

• Hedge Margin. In accordance with our fuel and interest rate hedge contracts, we were required to post $1.1 billion of margin with counterparties.

• Northwest financing facility. In October 2008, Northwest entered into a $500 million revolving credit facility (the "Revolving Credit Facility"),

which matures at the earlier of (1) October 2009 (with respect to $300 million of such facility) or October 2011 (with respect to $200 million of

such facility) or (2) the date that Northwest Airlines, Inc., is no longer a separate legal entity and an operating airline, including when it is merged

with and into Delta Air Lines, Inc. As of December 31, 2008, there were no outstanding borrowings under the facility.

For additional information regarding these matters, see Notes 4 and 6 of the Notes to the Consolidated Financial Statements.

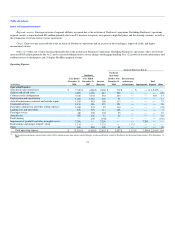

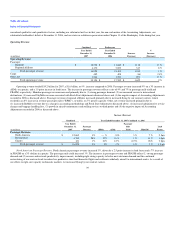

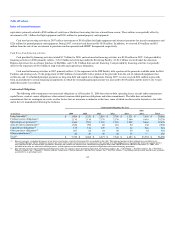

Combined Sources and Uses of Cash

Cash flows from operating activities

Cash used in operating activities totaled $1.7 billion for 2008, and cash provided by operating activities was $1.4 billion for 2007. Cash used in

operating activities for 2008 reflects (1) an increase in aircraft fuel payments due to record high fuel prices for most of the year, (2) the posting of $1.1 billion

in margin with counterparties primarily from our estimated fair value loss position on our fuel hedge contracts at December 31, 2008, (3) the payment of $438

million in premiums for fuel hedge derivatives entered into during 2008, (4) a $444 million decrease in advance ticket sales due to the slowing economy and

(5) the payment of $158 million in 2008 under our broad-based employee profit sharing plan related to 2007. Cash used in operating activities was partially

offset by cash flows driven by a $3.5 billion increase in operating revenue, $2.0 billion of which is directly attributable to Northwest's operations since the

Closing Date.

Cash flows from operating activities in 2007 reflect $875 million in cash used under Delta's Plan of Reorganization to satisfy bankruptcy-related

obligations under our comprehensive agreement with ALPA and settlement agreement with the PBGC. Cash flows from operating activities during 2007 also

reflect (1) the release of $804 million from restricted cash pursuant to an amendment to our Visa/Mastercard credit card processing agreement, (2) revenue

and network productivity improvements, including right-sizing capacity to better meet customer demand and the continued restructuring of our route network

to reduce less productive short haul domestic flights and reallocate widebody aircraft to international routes and (3) a $476 million decrease in short-term

investments primarily from sales of auction rate securities.

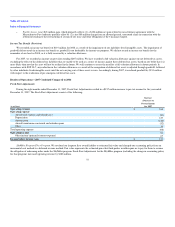

Cash flows from investing activities

Cash provided by investing activities totaled $1.6 billion for 2008, and cash used in investing activities was $625 million for 2007. Cash provided by

investing activities in 2008 reflects (1) the inclusion of $2.4 billion in cash and cash equivalents from Northwest in the Merger and (2) $609 million in

restricted cash and cash

43