Delta Airlines 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

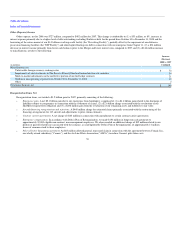

• Facility leases. A net $43 million gain, which primarily reflects (1) a $126 million net gain related to our settlement agreement with the

Massachusetts Port Authority partially offset by (2) a net $80 million charge from an allowed general, unsecured claim in connection with the

settlement relating to the restructuring of certain of our lease and other obligations at the Cincinnati Airport.

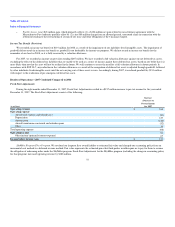

Income Tax Benefit (Provision)

We recorded an income tax benefit of $119 million for 2008 as a result of the impairment of our indefinite-lived intangible assets. The impairment of

goodwill did not result in an income tax benefit as goodwill is not deductible for income tax purposes. We did not record an income tax benefit for the

remainder of our loss for 2008, as it is fully reserved by a valuation allowance.

For 2007, we recorded an income tax provision totaling $207 million. We have recorded a full valuation allowance against our net deferred tax assets,

excluding the effect of the deferred tax liabilities that are unable to be used as a source of income against these deferred tax assets, based on our belief that it is

more likely than not that the asset will not be realized in the future. We will continue to assess the need for a full valuation allowance in future periods. In

accordance with SOP 90-7, any reduction in the valuation allowance as a result of the recognition of deferred tax assets is adjusted through goodwill, followed

by other indefinite-lived intangible assets until the net carrying cost of these assets is zero. Accordingly, during 2007, we reduced goodwill by $211 million

with respect to the realization of pre-emergence deferred tax assets.

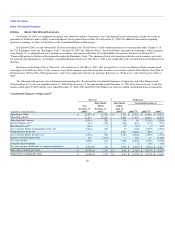

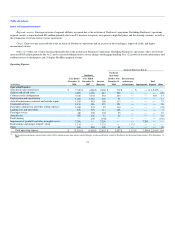

Results of Operations—2007 Combined Compared to 2006

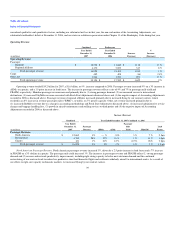

Fresh Start Adjustments

During the eight months ended December 31, 2007, Fresh Start Adjustments resulted in a $157 million increase to pre-tax income for the year ended

December 31, 2007. The Fresh Start Adjustments consist of the following:

(in millions)

Increase

(Decrease) to

Pre-tax Income

for 2007

Operating revenue $ 188

Operating expense

Aircraft fuel expense and related taxes (46)

Depreciation 127

Amortization (146)

Aircraft maintenance materials and outside repairs (52)

Other 19

Total operating expense (98)

Operating income 90

Other income (primarily interest expense) 67

Income before income taxes $ 157

SkyMiles Frequent Flyer Program. We revalued our frequent flyer award liability to estimated fair value and changed our accounting policy from an

incremental cost method to a deferred revenue method. Fair value represents the estimated price that third parties would require us to pay for them to assume

the obligation of redeeming miles under the SkyMiles program. Fresh Start Adjustments for the SkyMiles program (including the change in accounting policy

for that program) increased operating revenue by $188 million.

37