Delta Airlines 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

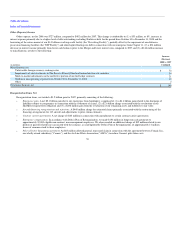

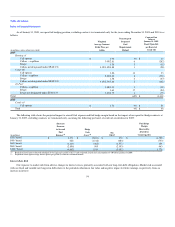

(3) This amount includes our noncancelable operating leases and our lease payments related to aircraft under our contract carrier agreements with ASA, Chautauqua, Freedom, Pinnacle,

Shuttle America and SkyWest Airlines.

(4) We have excluded from the table our order of 18 B-787-8 aircraft. The Boeing Company ("Boeing") has informed us that Boeing will be unable to meet the contractual delivery schedule

for these aircraft. We are in discussions with Boeing regarding this situation.

Our firm orders to purchase 33 B-737-800 aircraft include 31 B-737-800 aircraft, which we have entered into definitive agreements to sell to two third parties immediately following

delivery of these aircraft to us by the manufacturer. We have not received any notice that these parties have defaulted on their purchase obligations. These sales will reduce our future

commitments by approximately $1.3 billion during the period from 2009 through 2011 ($490 million, $730 million and $40 million for 2009, 2010 and 2011, respectively).

(5) Interest payments related to capital lease obligations are included in the table. The present value of these obligations, excluding interest, is included on our Consolidated Balance Sheets.

(6) Includes purchase obligations pursuant to which we are required to make minimum payments for goods and services, including but not limited to insurance, outsourced human resource

services, marketing, maintenance, technology, sponsorships and other third party services and products.

(7) Represents commitments to certain vendors for which we are obligated to generate specified amounts of revenue related to ticket booking fees.

(8) In addition to the contractual obligations included in the table, we have significant cash obligations that are not included in the table. For example, we will pay wages required under

collective bargaining agreements, fund pension plans (as discussed below) purchase capacity under contract carrier arrangements (as discussed below), settle tax contingency reserves (as

discussed below) and pay credit card processing fees and fees for other goods and services, including those related to fuel, maintenance and commissions. While we are parties to legally

binding contracts regarding these goods and services, the actual commitment is contingent on certain factors such as volume and/or variable rates that are uncertain or unknown at this

time. Therefore, these items are not included in the table. In addition, purchase orders made in the ordinary course of business are excluded from the table and any amounts which we are

liable for under the purchase orders are included in current liabilities on our Consolidated Balance Sheets. Payments under our profit-sharing plan or pursuant to our 2007 Performance

Compensation Plan are contingent on factors unknown at this time and, therefore, are not included in this table.

The following items are not included in the table above:

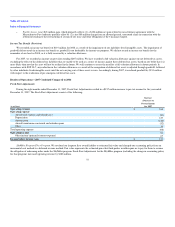

Pension Plans. We sponsor qualified defined contribution ("DC Plans") and defined benefit pension plans ("DB Plans") for eligible employees and

retirees. Our funding obligations for these plans are governed by ERISA. Estimates of pension plan funding requirements can vary materially from actual

funding requirements because the estimates are based on various assumptions, including those described below.

DC Plans. During 2008, we contributed approximately $215 million to our DC Plans or directly to employees that otherwise would have been

contributed to the DC Plans on their behalf, but for limits imposed by the Internal Revenue Code. In 2009, we expect to contribute approximately $300

million related to our DC Plans.

DB Plans. During 2008, we contributed approximately $115 million to our DB Plans, which include a defined benefit pension plan for eligible non-

pilot Delta employees and retirees (the "Delta Non-Pilot Plan") and defined benefit pension plans for eligible Northwest employees and retirees (the

"Northwest Pension Plans"). These plans have been frozen for future benefit accruals.

The Pension Protection Act of 2006 allows commercial airlines to elect alternative funding rules ("Alternative Funding Rules") for defined benefit plans

that are frozen. Under the Alternative Funding Rules, the unfunded liability for a frozen defined benefit plan may be funded over a fixed 17-year period and is

calculated using an 8.85% interest rate. Delta elected the Alternative Funding Rules for the Delta Non-Pilot Plan, effective April 1, 2007; and Northwest

elected the Alternative Funding Rules for the Northwest Pension Plans, effective October 1, 2006.

The Alternative Funding Rules allow us to reduce the funding obligations for the Delta Non-Pilot Plan and the Northwest Pension Plans over the next

several years compared to what our funding obligations would be under rules applicable to other DB plans. While the Alternative Funding Rules also make

our funding obligations for these plans more predictable, our estimates of future funding requirements of the Delta Non-Pilot Plan and

45