Delta Airlines 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208

|

|

Table of Contents

Index to Financial Statements

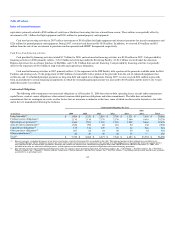

For 2008, aircraft fuel and related taxes, including our Contract Carriers, accounted for 28% of our total operating expense. Aircraft fuel and related

taxes increased 53% in 2008 compared to 2007 primarily due to higher average fuel prices. Fuel prices averaged $3.16 per gallon, including fuel hedge losses

of $65 million, for 2008 compared to $2.24 per gallon, including fuel hedge gains of $51 million, for 2007.

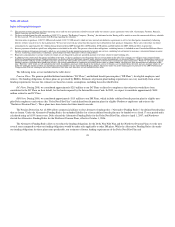

In the Merger, we assumed all of Northwest's outstanding fuel hedge contracts. On the Closing Date, we designated certain of Northwest's derivative

instruments, comprised of crude oil collar and swap contracts, as hedges in accordance with SFAS 133. As of December 31, 2008, these contracts had an

estimated fair value loss of $163 million. The remaining Northwest derivative contracts that were not designated as hedges had an estimated fair value loss of

$318 million. We will mark-to-market the derivative contracts not designated as hedges on a monthly basis in aircraft fuel expense and related taxes. The

mark-to-market on these contracts may result in increased volatility in earnings compared to our fuel hedge contracts designated under SFAS 133, for which

changes in underlying commodity prices result in valuation changes that are recorded in accumulated other comprehensive income.

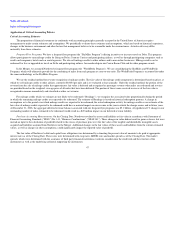

In September 2008, one of our fuel hedge contract counterparties, Lehman Brothers Holdings, Inc. ("Lehman Brothers"), filed for bankruptcy. As a

result, we terminated our fuel hedge contracts with Lehman Brothers prior to their scheduled settlement dates. Additionally, during the December 2008

quarter, we terminated certain fuel hedge contracts with other counterparties to reduce our exposure to projected fuel hedge losses due to the decrease in crude

oil prices. In accordance with SFAS 133, we recorded an unrealized loss of $324 million, which represents the effective portion of these terminated contracts

at the date of settlement, in accumulated other comprehensive income on our Consolidated Balance Sheet. These losses will be reclassified into earnings in

accordance with their original contract settlement dates through December 2009. The ineffective portion of these contracts at the date of settlement resulted in

an $11 million charge.

53