Delta Airlines 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

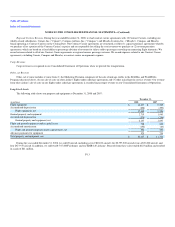

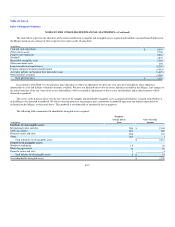

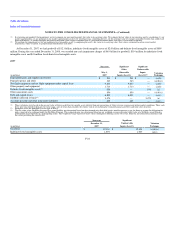

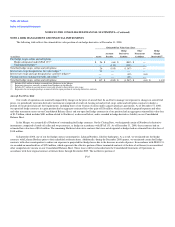

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

• Level 2. Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

• Level 3. Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

Assets and liabilities measured at fair value are based on one or more of three valuation techniques noted in SFAS 157. The three valuation techniques

are identified in the tables below. Where more than one technique is noted, individual assets or liabilities were valued using one or more of the noted

techniques. The valuation techniques are as follows:

(a) Market approach. Prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities.

(b) Cost approach. Amount that would be required to replace the service capacity of an asset (replacement cost).

(c) Income approach. Techniques to convert future amounts to a single present amount based on market expectations (including present value

techniques, option-pricing and excess earnings models).

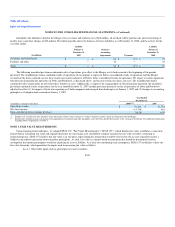

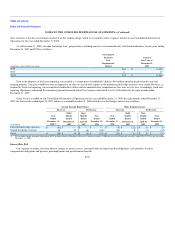

Assets and Liabilities Measured at Fair Value on a Recurring Basis

(in millions)

December 31,

2008

Quoted

Prices In

Active Markets

for Identical

Assets (Level 1)

Significant

Other

Observable

Inputs (Level 2)

Significant

Unobservable

Inputs (Level 3)

Valuation

Technique

Cash equivalents $ 4,020 $ 4,020 $ — $ — (a)

Short-term investments 212 — — 212 (c)

Restricted cash equivalents 128 128 — — (a)

Long-term investments 121 — — 121 (c)

Hedge derivatives liability, net (1,109) — (18) (1,091) (a)(c)

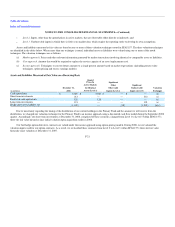

Due to uncertainty regarding the timing of the distribution of our current holdings in the Primary Fund and the amount we will receive from the

distribution, we changed our valuation technique for the Primary Fund to an income approach using a discounted cash flow model during the September 2008

quarter. Accordingly, our short-term investments at December 31, 2008, comprised of these securities, changed from Level 1 to Level 3 within SFAS 157's

three-tier fair value hierarchy since initial valuation upon acquisition earlier in 2008.

Our fuel hedge option derivative contracts are valued under the income approach using option-pricing models. During 2008, we reevaluated the

valuation inputs used for our option contracts. As a result, we reclassified these contracts from Level 2 to Level 3 within SFAS 157's three-tier fair value

hierarchy since valuation at December 31, 2007.

F-21