Delta Airlines 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

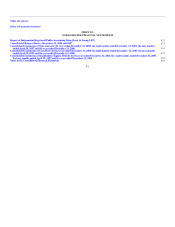

Table of Contents

Index to Financial Statements

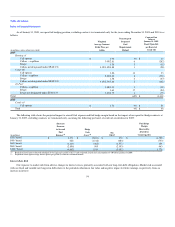

rates. We had $8.2 billion and $4.5 billion of fixed-rate debt and $9.7 billion and $3.8 billion of variable-rate debt at December 31, 2008 and 2007,

respectively. At December 31, 2008 an increase of 100 basis points in average annual interest rates would have decreased the estimated fair value of our

fixed-rate long-term debt by $155 million, inclusive of the impact of our interest rate swap agreements and increased interest expense on our variable-rate

long-term debt by $92 million, inclusive of the impact of our interest rate swap and cap agreements.

Foreign Currency Exchange Risk

Our results of operations may be impacted by foreign exchange rate fluctuations on the U.S. dollar value of foreign currency-denominated operating

revenues and expense. Our largest exposure comes from the Japanese yen. In general, a weakening yen relative to the U.S. dollar results in (1) our operating

income being unfavorably impacted to the extent net yen-denominated revenues exceed expenses and (2) recognition of a non-operating foreign currency gain

due to the remeasurement of net yen-denominated liabilities. To manage exchange rate risk, we execute both our international revenue and expense

transactions in the same foreign currency to the extent practicable. We believe changes in foreign currency exchange rates are not material to our results of

operations.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Reference is made to the Index on page F-1 of the Consolidated Financial Statements and the Notes thereto contained in this Form 10-K.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Our management, including our Chief Executive Officer and Chief Financial Officer, performed an evaluation of our disclosure controls and

procedures, which have been designed to permit us to effectively identify and timely disclose important information. Our management, including our Chief

Executive Officer and Chief Financial Officer, concluded that the controls and procedures were effective as of December 31, 2008 to ensure that material

information was accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to

allow timely decisions regarding required disclosure.

Changes In Internal Control

Except as set forth below, during the three months ended December 31, 2008, we did not make any changes in our internal control over financial

reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

On October 29, 2008, we completed our Merger with Northwest. As permitted by the Securities and Exchange Commission, management has elected to

exclude Northwest from management's assessment of the effectiveness of our internal control over financial reporting for the year ended December 31, 2008.

Management's Annual Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in

Rules13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934.

55