Delta Airlines 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

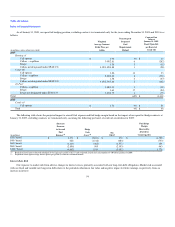

Fair value measurements for goodwill and other intangible assets included significant unobservable inputs, which generally include a five-year business

plan, 12-months of historical revenues and expenses by city pair, projections of available seat miles, revenue passenger miles, load factors, and operating costs

per available seat mile and a discount rate.

One of the significant inputs underlying the intangible fair value measurements performed on the Closing Date is the discount rate. We determined the

discount rate using the weighted average cost of capital of the airline industry, which was measured using a Capital Asset Pricing Model ("CAPM"). The

CAPM in the valuation of goodwill and indefinite-lived intangibles utilized a 50% debt and 50% equity structure. The historical average debt-to-equity

structure of the major airlines since 1990 is also approximately 50% debt and 50% equity, which was similar to Northwest's debt-to-equity structure at

emergence from Chapter 11. The return on debt was measured using a bid-to-yield analysis of major airline corporate bonds. The expected market rate of

return for equity was measured based on the risk free rate, the airline industry beta, and risk premiums based on the Federal Reserve Statistical Release H. 15

or Ibbotson® Stocks, Bonds, Bills, and Inflation® Valuation Yearbook, Edition 2008. These factors resulted in a 13% discount rate. This compares to an 11%

discount rate used at emergence by Northwest.

The fair value of Northwest's pension and postretirement plans was determined by measuring the plans funded status as of the closing of the Merger.

Any excess projected benefit obligation over the fair value of plan assets was recognized as a liability. One of the significant assumptions in determining our

projected benefit obligation is the discount rate. We determined the discount rate primarily by reference to annualized rates earned on high quality fixed

income investments and yield-to-maturity analysis specific to estimated future benefit payments, which resulted in a weighted average discount rate of 7.8%.

Other significant assumptions include the healthcare cost trend rate, retirement age, and mortality assumptions. These assumptions are discussed further in

Note 10 of the Notes to the Consolidated Financial Statements.

Derivative Instruments. In an effort to manage our exposure to changes in aircraft fuel prices, we periodically enter into derivative instruments

comprised of crude oil, heating oil and jet fuel swap, collar, and call option contracts to hedge a portion of our projected aircraft fuel requirements, including

those of our Contract Carriers under capacity purchase agreements. We record our derivative contracts in accordance with SFAS No. 133, "Accounting for

Derivative Instruments and Hedging Activity" ("SFAS 133"). Our fuel derivative instruments are valued using market data derived from quantitative models

and processes to generate forward curves and volatilities.

We believe our fuel hedge contracts will be highly effective during their term in offsetting changes in cash flow attributable to the volatility in jet fuel

prices. We perform both a prospective and retrospective assessment to this effect, at least quarterly, including assessing the possibility of counterparty default.

If we determine that a derivative is no longer expected to be highly effective, we discontinue hedge accounting prospectively and recognize subsequent

changes in the fair value of the hedge on our Consolidated Statements of Operations. As a result of our effectiveness assessment at December 31, 2008, we

believe our hedge contracts will continue to be highly effective in offsetting changes in cash flow attributable to the volatility in jet fuel prices.

48