Delta Airlines 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

these contracts at the date of settlement resulted in an $11 million charge, which we recorded to other (expense) income on our Consolidated Statement of

Operations for the year ended December 31, 2008.

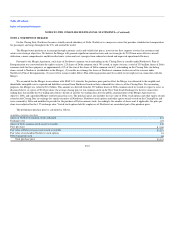

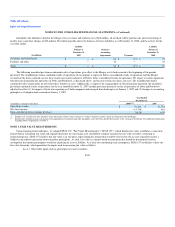

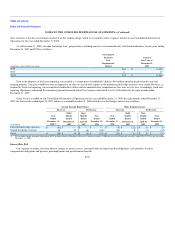

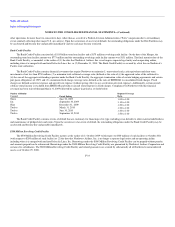

As of December 31, 2008, our open fuel hedge (loss) gain position, excluding contracts we terminated early with Lehman Brothers, for the years ending

December 31, 2009 and 2010 is as follows:

(in millions, unless otherwise stated)

Percentage of

Projected

Fuel

Requirements

Hedged

Contract

Fair Value at

December 31,

2008

2009 48% $ (1,059)

2010 4 19

Total 26% $ (1,040)

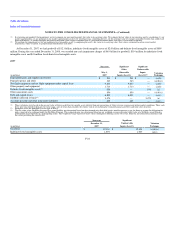

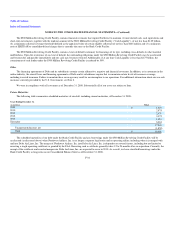

Prior to the adoption of fresh start reporting, we recorded as a component of stockholders' deficit a $46 million unrealized gain related to our fuel

hedging program. This gain would have been recognized as an offset to aircraft fuel expense as the underlying fuel hedge contracts were settled. However, as

required by fresh start reporting, our accumulated stockholders' deficit and accumulated other comprehensive loss were reset to zero. Accordingly, fresh start

reporting adjustments eliminated the unrealized gain and increased aircraft fuel expense and related taxes by $46 million for the eight months ended

December 31, 2007.

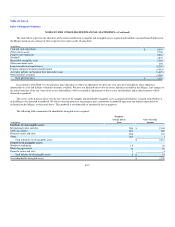

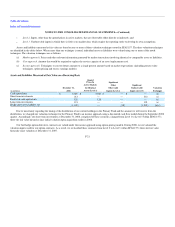

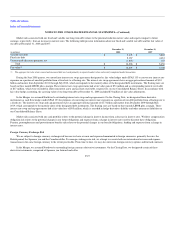

Gains (losses) recorded on our Consolidated Statements of Operations for the year ended December 31, 2008, the eight months ended December 31,

2007, the four months ended April 30, 2007 and the year ended December 31, 2006 related to our fuel hedge contracts are as follows:

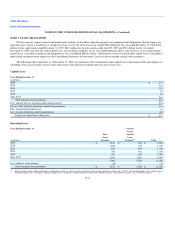

Aircraft Fuel and Related Taxes Other (Expense) Income

Successor Predecessor Successor Predecessor

(in millions)

Year

Ended

December 31,

2008(1)

Eight

Months

Ended

December 31,

2007

Four

Months

Ended

April 30,

2007

Year

Ended

December 31,

2006

Year

Ended

December 31,

2008

Eight

Months

Ended

December 31,

2007

Four

Months

Ended

April 30,

2007

Year

Ended

December 31,

2006

Unsettled fuel hedge contracts $ (91) $ — $ — $ — $ (4) $ (21) $ 15 $ (5)

Settled fuel hedge contracts 26 59 (8) (108) (16) 8 (1) (32)

Total $ (65) $ 59 $ (8) $ (108) $ (20) $ (13) $ 14 $ (37)

(1) We recorded a mark-to-market adjustment of $91 million related to Northwest derivative contracts settling in 2009 that were not designated as hedges under SFAS 133 for the year ended

December 31, 2008.

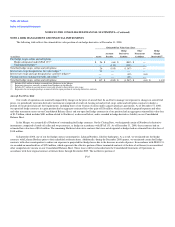

Interest Rate Risk

Our exposure to market risk from adverse changes in interest rates is associated with our long-term debt obligations, cash portfolio, workers'

compensation obligations and pension, postemployment and postretirement benefits.

F-26