Delta Airlines 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

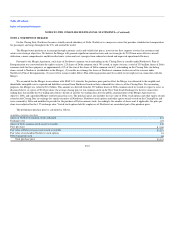

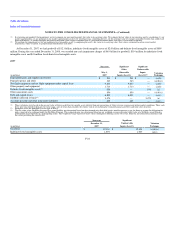

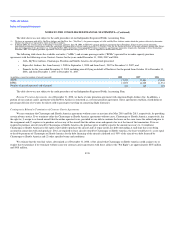

contracts, as cash flow hedges under SFAS 133. The forward and collar contracts have an aggregate notional amount of 45 billion Japanese yen maturing

monthly between January 2009 and December 2009. As of December 31, 2008, we have hedged approximately 30% of anticipated 2009 yen-denominated

cash flows from sales. These foreign currency derivative instruments had a fair value loss of $48 million, which is recorded in hedge derivatives liability on

our Consolidated Balance Sheet.

We did not have any foreign currency hedge contracts at December 31, 2007.

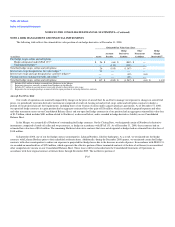

Credit Risk

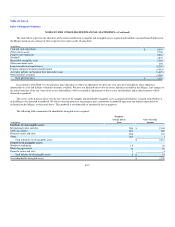

To manage credit risk associated with our aircraft fuel price and interest rate hedging programs, we select counterparties based on their credit ratings

and limit our exposure to any one counterparty. We also monitor the market position of this program and our relative market position with each counterparty.

Due to the continued decline in crude oil prices during the December 2008 quarter, we realized a significant increase to our estimated fair value loss

position on our fuel hedge contracts. Accordingly, counterparties required us to post $1.2 billion of fuel hedge margin, which is recorded in hedge margin

receivable on our Consolidated Balance Sheet at December 31, 2008.

Due to the significant changes in interest rates during the December 2008 quarter, our interest rate swap agreements designated as fair value hedges

were in a gain position. Accordingly, we required counterparties to post $91 million of margin associated with these agreements. The margin has been

recorded to hedge margin receivable on our Consolidated Balance Sheet as a reduction to the fuel hedge margin counterparties required us to post.

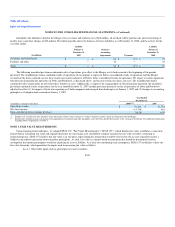

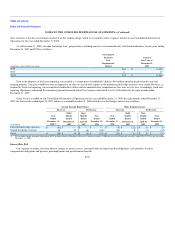

Our accounts receivable are generated largely from the sale of passenger airline tickets and cargo transportation services. The majority of these sales are

processed through major credit card companies, resulting in accounts receivable that may be subject to certain holdbacks by the credit card processors.

We also have receivables from the sale of mileage credits under our SkyMiles and WorldPerks Programs to participating airlines and non-airline

businesses such as credit card companies, hotels and car rental agencies. We believe the credit risk associated with these receivables is minimal and that the

allowance for uncollectible accounts that we have provided is appropriate.

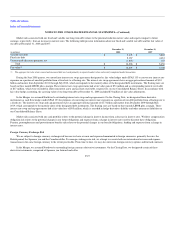

Self-Insurance Risk

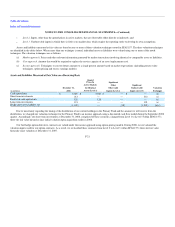

We self-insure a portion of our losses from claims related to workers' compensation, environmental issues, property damage, medical insurance for

employees and general liability. Losses are accrued based on an estimate of the ultimate aggregate liability for claims incurred, using independent actuarial

reviews based on standard industry practices and our historical experience. A portion of our projected workers' compensation liability is secured with

restricted cash collateral.

F-28